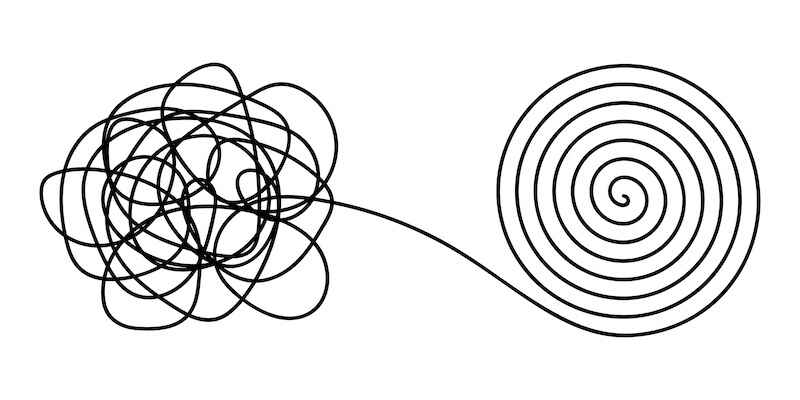

The stock market can be messy and unpredictable. Sometimes the stocks of good companies go nowhere, and sometimes the stocks of garbage companies skyrocket.

For traders and investors, it helps to have a way to make sense of it all.

Early in my career, I was floundering. I read every book I could find on how to analyze companies, and I read Investor’s Business Daily and The Wall Street Journal every day. I thought I knew what should happen in the market and in individual stocks… but often, that wasn’t what would happen.

It was maddening having all of this new knowledge but not being able to apply it successfully.

Then I caught a lucky break: I took a course on technical analysis and how to spot patterns in the stock market.

And it changed everything.

“I See Patterns”

Like Haley Joel Osment hesitating to admit he could see dead people in The Sixth Sense, it took me a little while to acknowledge the patterns I was noticing. After all, I had spent a lot of time learning about fundamentals like price-to-earnings ratio and operating margin, and I’d been told they were the true way to make money in the market.

But once I saw how effective patterns could be in helping me time my entries and exits, I embraced them quickly.

There are several different types of patterns.

One of the most common is a formation on a stock chart, like a head and shoulders pattern.

This is a very bearish pattern. It occurs when a stock falls to the same level (the neckline) after three successive peaks, with the middle peak (the head) being higher than the first and third peaks (the shoulders).

In the example above, fundamental analysis might’ve told you in late June that this stock was a good value, that the company was likely to grow its earnings, and that the stock would be a strong buy.

But you might have changed your mind if you’d looked at the chart and spotted the head and shoulders pattern. That would’ve indicated that it’d be smart to wait to see if the stock was going to fall, allowing you to buy it cheaper.

Perhaps your fundamental analysis would have been proven right in the long term. But by knowing this pattern, you could have saved yourself some money and heartache by not being in the stock while it was falling.

There are other important patterns that can’t necessarily be seen on a stock chart. One common pattern is described by the adage “sell in May and go away.”

The saying refers to the fact that stocks tend to perform much better from the months of November to April than they do from May to October.

In the 20th century, the average monthly return of the S&P 500 from November to April was 1.05%, versus just 0.27% from May to October.

More recently, since 1990, stocks have returned an average of 7% from November to April but just 2% from May through October.

There are lots of other patterns that have repeated over time, such as how stocks perform during the presidential cycle, how they perform based on which day of the week or month they’re purchased, etc.

Now, none of these patterns are crystal balls… but history does repeat itself. Stocks and markets often repeat past moves because they are pushed and pulled by human emotion, and that does not change over the years. Using these patterns will increase your odds of success.

If you’re not using patterns in your trading, start educating yourself. Your broker’s website is a good place to start, as it likely has lots of good, free information.

Learning how to recognize various patterns in the market changed the game for me. It made order out of chaos and made me a much more profitable trader and investor.