“Dividends [are] the critical factor giving the edge to most winning stocks in the long run.” – Jeremy Siegel, Wizard of Wharton

Writing my newsletter for nearly 40 years, I have gradually shifted my stock recommendations to dividend-paying stocks. I call it the “SWAN” (sleep well at night) strategy. This strategy recommends stocks that:

- Do well in a growing industry

- Pay above-average dividends

- Adopt a rising-dividend policy.

It seems to be working, as my high-income portfolio has beaten the market for at least 15 years, and counting.

Granted, I miss out on some incredible startup growth stocks that don’t pay a dividend and have done well over the years, including Amazon (Nasdaq: AMZN) and Warren Buffett’s Berkshire Hathaway (NYSE: BRK-A).

But I also avoid companies that never get off the ground. By the time a company pays a dividend, it’s a sign it has built something that will last. As Doug Casey says, “Dividends are an outward sign of inward grace.”

Dividend Payers Beat the Market, But…

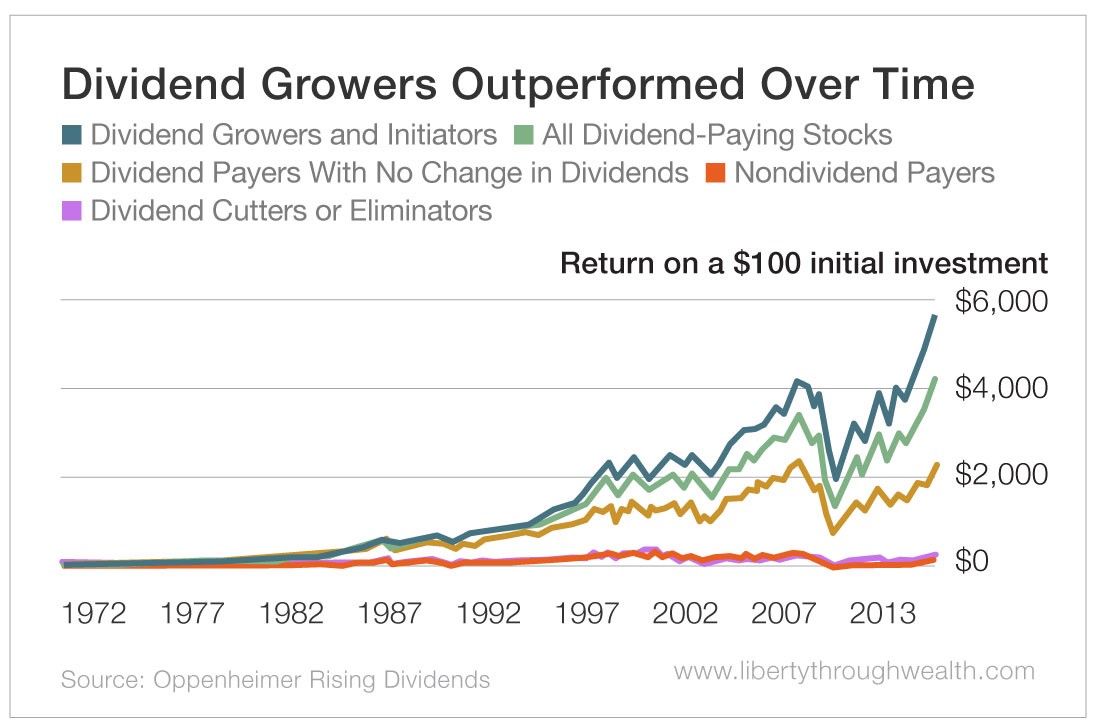

Still, investing in dividend stocks is no guarantee you will make money every year. As the chart below shows, dividend stocks are cyclical, just like growth stocks. They can also fall during a bear market. But dividends help cushion the fall. While you wait for recovery, you can be comforted knowing those dividends will keep coming.

The Case Against Dividend Stocks

Last week, I had the privilege of hosting Joel Stern, professor of finance at Carnegie Mellon and inventor of the concept of economic value added (EVA), which measures the opportunity cost of capital. Professor Stern is a brilliant economist and, in my opinion, deserves the Nobel Prize for his EVA invention.

Stern is a longtime friend and a regular at my big show in Vegas, FreedomFest, but we disagree on one major issue: dividends.

He argues companies that pay dividends are admitting they can no longer grow much, so they pay out their profits to shareholders. Moreover, when a stock pays a dividend, the stock price typically drops by the amount of the dividend, and there is no real gain.

He agrees with Warren Buffett: Paying out a dividend is when a company admits defeat – the executives don’t know how to grow the company anymore, so they start paying a dividend. Buffett, like many business leaders, feels that investing back into his business provides more long-term value to shareholders than paying them directly because the company’s financial success rewards shareholders with higher stock values.

However, note that Buffett does believe in paying back shareholders. He has implemented an aggressive stock buyback plan at Berkshire Hathaway. And his fund also invests in companies that pay dividends, such as Apple (Nasdaq: AAPL), Coca-Cola (NYSE: KO), Phillips 66 (NYSE: PSX) and Wells Fargo (NYSE: WFC).

Then Why Do Rising-Dividend Stocks Outperform?

Rob Arnott, president of Research Affiliates and the father of “smart beta” investing, says evidence contradicts Stern’s thesis. In his debate with Stern at last year’s FreedomFest, Arnott noted the more a public company pays out in dividends, the more its earnings grow.

In 2003, Arnott co-authored “Surprise! Higher Dividends = Higher Earnings Growth” with Cliff Asness, which demonstrates just that.

In another study, Arnott showed that companies with a high payout ratio (dividends as a percentage of earnings) tend to outperform stocks with a low payout ratio – as long as the company’s payout ratio does not exceed 100%.

Why? The belief is companies that have publicly announced a high and growing dividend policy are likely to work hard to continue that policy.

Lowell Miller, a money manager who follows a rising-dividend investment program, concludes, “Dividend growth is the true signal of a prospering company.” His formula for “investing with peace of mind” is this:

High Quality + High Yield + Growth of Yield = High Total Return.

There are several ETFs that focus on companies paying rising dividends. One recommended by Nicholas Vardy is the ProShares S&P 500 Aristocrats ETF (CBOE: NOBL). Its annual yield is only 1.8%, but it has beaten the S&P 500 since its inception in 2013.

I get a kick out of this famous line from John D. Rockefeller: “Do you know the only thing that gives me pleasure? It is to see my dividends coming in.”

Good investing, AEIOU,

Mark

P.S. Half Off The Maxims of Wall Street

Hundreds of valuable Wall Street sayings, like the ones mentioned above, are found in my unique collection, The Maxims of Wall Street, now in its fifth edition with over 25,000 in print. The book contains more than 800 quotes, proverbs, poems and short stories offering a wealth of insights about investing. The book is endorsed by Warren Buffett, Alexander Green, Nicholas Vardy and Jack Bogle. Dennis Gartman says, “It’s amazing the depth of wisdom one can find in just one or two lines from [The Maxims of Wall Street]. I keep it on my desk and refer to it often.”

And there’s a special deal for Oxford Club Members. Buy the first copy for $20 and all additional copies are only $10. They make great gifts for friends, investors and clients. I pay the U.S. postage and autograph each copy. Also, if you order an entire box of 32 books, you pay only $300 postpaid. Hetty Green said it best, “When I see something cheap, I buy a lot of it.”

To order, call Harold at Ensign Publishing, 1.866.254.2057, or go to www.skousenbooks.com. (For orders outside the U.S., contact Harold at Ensign Publishing for additional charges.)

Mark Skousen is a true believer in reason, self-determination, hard work and liberty. Since 1980, Mark has been the editor-in-chief of the award-winning investment newsletter Forecasts & Strategies. He’s a successful author and publisher of several books, including The Maxims of Wall Street and Investing in One Lesson. He is also the founder of FreedomFest, an annual gathering in Las Vegas of the freedom movement from around the world.