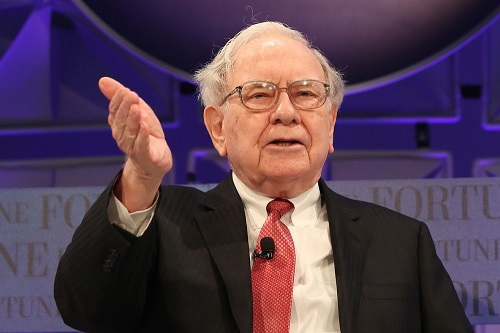

Millions of people around the country – and around the world – dream about investing like Warren Buffett.

It’s not hard to see why.

Had you invested $10,000 in his holding company, Berkshire Hathaway (NYSE: BRK-A), when he took the helm 53 years ago, it would have grown to $196 million by the end of last year.

(That’s the power of money compounding at 20.5% annually.)

Of course, rather than just wishing to invest like Buffett, you could emulate him by following the sage advice and opinions he dispenses in his annual letter to shareholders.

The 2018 report came out a few weeks ago and, as usual, contained several nuggets worth contemplating and adopting.

A few are below.

Since Buffett is a lucid and straightforward writer, I’ve restricted my commentary to a few brief translations:

“Investors who evaluate Berkshire sometimes obsess on the details of our many and diverse businesses, our economic ‘trees’ so to speak… A few of our trees are diseased and unlikely to be around a decade from now. Many others, though, are destined to grow in size and beauty.”

Translation: Some of your investments simply will not work out. That’s no reason to despair since others will. A stock can decline 100%, but that risk is more than offset by the fact that it can also rise many hundreds of percent.

“Our prime goal in the deployment of your capital: to buy ably managed businesses, in whole or in part, that possess favorable and durable economic characteristics. We also need to make these purchases at sensible prices.”

Translation: The stocks in your portfolio are not poker chips or lottery tickets. They represent a fractional interest in various businesses. Deciding whether to own them or hold them means comparing their current prices with their future prospects.

“Charlie [Munger] and I have no idea as to how stocks will behave next week or next year. Predictions of that sort have never been a part of our activities.”

Translation: Economic forecasting doesn’t work and neither does jumping in and out of the market. Investment success is about “time in the market,” not “timing the market.”

“We use debt sparingly… At rare and unpredictable intervals, credit vanishes and debt becomes financially fatal… Rational people don’t risk what they have and need for what they don’t have and don’t need.”

Translation: Using margin may goose your returns in an up market, but it can be your undoing in a bear market. A 50% decline in stocks – which has happened twice in the last 30 years and will almost certainly happen again – can cut the value of your portfolio in half. But it will wipe out a fully leveraged portfolio.

“Charlie and I do not view the $172.8 billion [Berkshire stock holdings]… as a collection of ticker symbols – a financial dalliance to be terminated because of downgrades by ‘the Street,’ expected Federal Reserve actions, possible political developments, forecasts by economists or whatever else might be the subject du jour. What we see in our holdings, rather, is an assembly of companies.”

Translation: Successful investing is not about outguessing the Fed, forecasting GDP growth or predicting next year’s election winners. Again… it’s about evaluating, monitoring and reappraising the various businesses you own.

“Much of Berkshire’s success has simply been a product of what I think should be called The American Tailwind… We are lucky – gloriously lucky – to have that force at our back.”

Translation: Despite more than 200 years of wars, recessions, inflation, political upheavals and financial crises, nothing has outperformed a diversified portfolio of high-quality U.S. stocks over the long haul. And that isn’t likely to change.

You can let the gloom-and-doomers scare you out of the market with their continual predictions of a coming currency crash, economic collapse or Greater Depression.

But expect your long-term results – from holding cash, selling short or buying puts – to be just as miserable in the future as in the past.

And blame yourself, not them.

After all, you could have listened to the greatest investor of all time… or a gaggle of scaremongering nobodies.

And you chose the latter.

Good investing,

Alex