“Outside of a dog, a book is man’s best friend. Inside of a dog, it’s too dark to read.”

– Groucho Marx

This quote about reading (and dogs) has always made me laugh. There is nothing I enjoy more than curling up with my dogs and a good book. Books can transport you to another place, teach you a new skill or open your world to new possibilities.

Renowned investor and Berkshire Hathaway CEO Warren Buffett – now in his late 80s – still spends five to six hours a day reading. While speaking to an investing class at Columbia Business School, Buffett once advised, “Read 500 pages… every day. That’s how knowledge works. It builds up, like compound interest. All of you can do it.”

Whether you’re a seasoned investor or just getting your feet wet, there is plenty that you can learn from the world’s best investors.

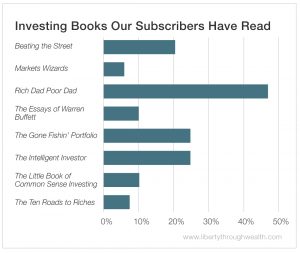

We recently polled subscribers to find out which of Liberty Through Wealth’s top recommended investing books they’ve read.

Rich Dad Poor Dad by Robert Kiyosaki was the clear winner at 47%. Not surprising, considering it’s one of the best-selling financial books of all time. Since publication, it has sold more than 32 million copies in 40 languages across 40 countries.

Want to know more? Take a closer look at Liberty Through Wealth’s list of top investing books for everyone… and pick the one that’s right for you!

The Investing Book for New Investors

The Intelligent Investor by Benjamin Graham

“Investing is a unique kind of casino – one where you cannot lose in the end, so long as you play only by the rules that put the odds squarely in your favor.”

– Benjamin Graham

Graham – the father of value investing – was a legendary investor and mentor to Buffett. Considered the stock market bible since its original publication in 1949, The Intelligent Investor lays out Graham’s value investing philosophy, which shields investors from error and focuses on long-term strategies. The revised edition provides an even better understanding of Graham’s principles and how to apply them, drawing parallels between Graham’s ideas and today’s headlines.

The Investing Book for Researchers

Beating the Street by Peter Lynch

“This is one of the keys to successful investing: focus on the companies, not on the stocks.”

– Peter Lynch

Alexander Green has described Lynch as the greatest stock fund manager of all time. In Beating the Street, Lynch shares his own strategies and offers advice on picking stocks and mutual funds to create an investment portfolio. He explains how to become an expert in a company and build a profitable portfolio based on your own experience, insights and research. Following Lynch’s step-by-step strategies, investors can improve their performance to rival the experts.

The Investing Book for Serious Traders

Market Wizards: Interviews with Top Traders by Jack Schwager

“If you don’t stay with your winners, you are not going to be able to pay for the losers.”

– Jack Schwager

According to Nicholas Vardy, “Thirty years after its publication, Schwager’s book still sets the standard by which all similar books are judged.” In Market Wizards, Schwager sets out to answer this question: What separates the world’s top traders from the vast majority of successful investors? The book’s simple format and expert financial advice make it a must-read for anyone interested in gaining insight into the world of finance.

The Investing Book for Busy Professionals

The Gone Fishin’ Portfolio: Get Wise, Get Wealthy… And Get On With Your Life by Alexander Green

“Money is not your most precious resource. It’s time. Your time is limited, perishable, irreplaceable and, unlike money, cannot be saved.”

– Alexander Green

Written by our Chief Investment Strategist, this timeless guide will show you how to consistently earn market-beating returns while reducing your risk. Alex’s battle-tested strategy embraces the uncertainty of the financial markets – and life in general. The Gone Fishin’ Portfolio is based on a Nobel Prize-winning investment strategy and takes very little time to implement and manage – leaving more time for fishin’ (or anything else).

The Investing Book for Practical Thinkers

The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns by John Bogle

“Buying funds based purely on their past performance is one of the stupidest things an investor can do.”

– John Bogle

It’s not easy to become a successful investor, but it is simple – it’s all about common sense. In The Little Book of Common Sense Investing, Bogle, founder of The Vanguard Group and creator of the world’s first index mutual fund, explains how he used index investing to build substantial wealth. Bogle provides deep insights and practical advice to help readers incorporate this proven strategy into their portfolios.

The Investing Book for Unconventional Thinkers

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! by Robert Kiyosaki

“Winners are not afraid of losing. But losers are. Failure is part of the process of success. People who avoid failure also avoid success.”

– Robert Kiyosaki

In Rich Dad Poor Dad, Kiyosaki shares his unique economic perspective – influenced by his father, who was highly educated but fiscally poor, and his best friend’s father, who dropped out of school and went on to become a self-made millionaire. Of the Rich Dad Poor Dad approach, our advisory panelist Mark Skousen has said, “Certainly most rich people – like those on the Forbes 400 Richest Americans – have followed the Kiyosaki formula.”

The Investing Book for Wannabe Philosophers

The Essays of Warren Buffett edited by Lawrence Cunningham

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

– Warren Buffett

Buffett – the “Oracle of Omaha,” whom Alex Green considers the most successful value investor of all time – shares many gems of financial wisdom with his Berkshire Hathaway shareholders. This easily digestible compilation of excerpts from his shareholder letters is organized by topic and importance. It culls Buffett’s most meaningful passages about his investment philosophy and principles from across the years.

The Investing Book for Superfans

The Ten Roads to Riches: The Ways the Wealthy Got There (And How You Can Too!) by Ken Fisher

“It’s true that not everyone can become rich. But it’s clear to me that most people can – they just don’t know how. If more people knew how, we would have more rich people and the world would be a better place.”

– Ken Fisher

In The Ten Roads to Riches, investment expert and self-made billionaire Fisher lays out the 10 roads to riches: starting a business, owning real estate, investing wisely and so on. He provides an engaging and informative look at some of today’s most famous millionaires (and billionaires) and how they made their fortunes. Fisher explains how, whether investors are just starting out or well on their way to wealth, they can realistically get – and stay – rich.

Will you be adding these or any other investing books to your reading list? Let us know which ones in the comments!