Alexander Green is an analyst, author and speaker whose primary mission is to show investors how to achieve and maintain financial independence. For 16 years, he worked as an investment advisor, research analyst and portfolio manager on Wall Street. He has been the Chief Investment Strategist of The Oxford Club since 2001. He has written several New York Times bestsellers, including The Gone Fishin’ Portfolio, Beyond Wealth, The Secret of Shelter Island and An Embarrassment of Riches.

Alexander Green is an analyst, author and speaker whose primary mission is to show investors how to achieve and maintain financial independence. For 16 years, he worked as an investment advisor, research analyst and portfolio manager on Wall Street. He has been the Chief Investment Strategist of The Oxford Club since 2001. He has written several New York Times bestsellers, including The Gone Fishin’ Portfolio, Beyond Wealth, The Secret of Shelter Island and An Embarrassment of Riches.

In addition to directing The Oxford Communiqué (as well as The Oxford Communiqué Pro), he oversees three fast-paced VIP Trading Research Services: Oxford Microcap Trader, The Momentum Alert and The Insider Alert. He also writes for Liberty Through Wealth, a free e-letter focused on financial freedom that has more than 200,000 subscribers.

Economies expand and contract. Interest rates rise and fall. Markets gyrate up and down.

And nobody gives you a warning ahead of time.

It’s a bit unsettling, especially when your life savings are on the line.

Wouldn’t it be great if you could bulletproof your investments, so you’re prepared for whatever the future holds?

In fact, you can. You need only follow 10 battle-tested principles that have stood the test of time…

1. Don’t try to forecast the economy.

The national and global economy today is too big, dynamic and complex for anyone – from corporate executives to central bank presidents – to accurately predict.

So if you’re running your portfolio based on someone’s guess about how long the economic expansion will last or when the next recession will arrive, you’re already off on the wrong foot.

Twice a year, The Wall Street Journal polls 55 of the nation’s leading economists and asks what lies ahead for the economy, interest rates, inflation and the dollar. Most are way off. (Their consensus isn’t so hot either.)

It’s gotten to the point where even The Wall Street Journal staff is in on the joke. Reporter Jesse Eisinger writes…

Pity the poor Wall Street economist. Big staffs, sophisticated models, reams of historical data, degrees from schools known by merely the name of the biggest benefactor, and still they forecast about as well as groundhogs.

Punxsutawney Phil may actually have an edge on most of them.

2. Don’t time the market.

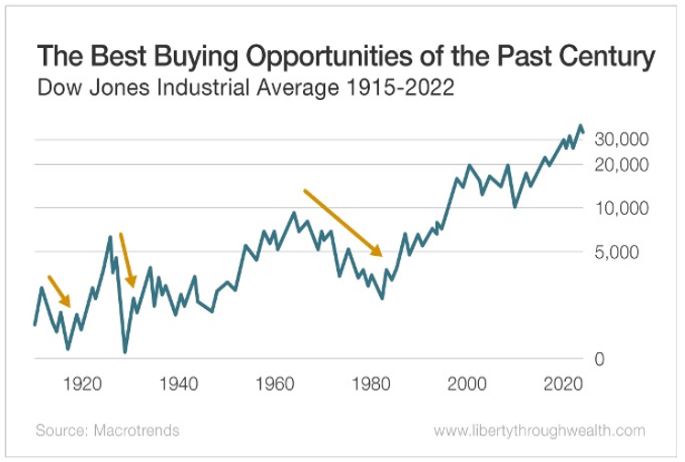

It seems so easy when you look at a chart of past bull and bear markets. If you’d only gotten in down here and then out somewhere up there and then back in around here.

As they say in New York, “Fuhgeddaboudit.”

To try to switch into the market for the rallies and out for the corrections – or just call the major turns every decade or so – is a waste of time and money.

It can’t be done.

Sure, anyone can make a good call. (And don’t think they won’t keep reminding you.) But to successfully time the market you have to make at least three: You have to buy at the right time, get out at the right time and then buy back in at the right time. Otherwise, the plane will leave you at the airport… since the long-term direction of the stock market is up.

Vanguard founder Jack Bogle calls market timing “the loser’s game” and adds, “After nearly 50 years in this business, I do not know of anybody who has done it successfully and consistently. I don’t even know anybody who knows anybody who has.”

3. Save more.

The 2022 Retirement Confidence Survey revealed that millions of Americans are woefully unprepared for retirement. The single biggest reason is they haven’t saved enough.

More than a quarter of American workers (19%) have put aside less than $1,000 for retirement. Twenty-seven percent have saved less than $10,000. And one-third have accumulated less than $25,000.

Millions of Americans today believe the government will deliver the material happiness they deserve, sparing them the trouble and discomfort of striving.

Unfortunately, the average retired worker receives just $1,669 a month from Social Security. (If you include spousal benefits, it climbs to $2,509.)

To ensure a comfortable retirement, you need to save as much as you can, for as long as you can, starting as soon as you can.

4. Asset allocate your portfolio.

Asset allocation is the process of finding the optimal mix of investments for your portfolio.

I’m not talking about which securities you buy. Asset allocation refers to how you divide your assets among stocks, bonds and other noncorrelated assets to give yourself the best chance of reaching your financial goals while taking as little risk as possible.

Asset allocation is your single biggest investment decision, responsible for approximately 90% of your portfolio’s long-term returns.

What is the best asset allocation? Opinions vary. But The Oxford Club’s recommended asset allocation is 30% U.S. equities (divided evenly among large cap and small cap stocks), 30% international equities (divided in thirds between Europe, Asia and emerging markets), 10% each in high-grade bonds, high-yield bonds and Treasury Inflation-Protected Securities (TIPS), and 5% each in real estate investment trusts (REITs) and shares of gold mining companies.

This mix has outperformed the S&P 500 over the last 20 years while taking far less risk than being fully invested in stocks.

5. Rebalance your portfolio.

Each of these asset classes should generate returns that exceed inflation over the long haul. However, they won’t move in lockstep. And that’s a good thing.

Once a year – the date is not important – you need to rebalance your portfolio. That means returning the portfolio to its original percentages by selling back the asset classes that have appreciated the most and putting the proceeds to work in the assets that have lagged the most.

Doing this forces you to sell high and buy low. It adds about a point a year to your total return while also reducing your risk, since you are paring back on the assets that are most extended.

It may feel wrong to liquidate a portion of asset classes that have done well. (After all, with individual securities the goal is to let your profits run.) But asset classes move in unpredictable up and down cycles. Rebalancing allows you to take advantage of that.

In short, investors should ignore the siren call of market timers and economic forecasters, save more, asset allocate properly, and rebalance annually.

Covering these bases will keep you on track to reach your most important financial goals.

But if you really want to bulletproof your portfolio, there are five other steps you need to take as well.

Here are the final five steps that will wrap your nest egg in Kevlar…

6. Cut your investment costs.

In most walks of life, you get what you pay for. This is emphatically not the case when it comes to investment managers.

Every year, 3 out of 4 active fund managers fail to outperform their unmanaged benchmarks. Over periods of a decade or more, more than 95% of them fail.

Do you really want to pay hefty fees to someone with less than a 1-in-20 chance of delivering the goods?

Investment fees and returns are inversely correlated. The more your advisor makes, the less you do.

This is particularly true in the fixed income area. Ten-year Treasurys currently pay about 3.3%, for example. If you plunk for a bond fund with a 1% expense ratio, the fund is taking almost a third of your yield.

The goal is for you to get rich, not your broker or advisor.

7. Minimize your tax liabilities.

During my time as a money manager, I was surprised how many people paid little or no attention to the tax consequences of their investment maneuvers.

Minimizing your annual tax bite is crucial to reaching your long-term financial goals. How do you do it?

- Avoid actively managed mutual funds. Not only do the vast majority of them underperform their benchmarks – see No. 6 – but you’ll get hit with regular capital gains distributions, even in the down years.

- Minimize turnover. Warren Buffett rightly notes that the capital gains tax is not a tax on capital gains. It’s a tax on transactions. So he makes as few as possible, insisting that his favorite holding period is “forever.”

- Do your short-term trading in a qualified retirement account. This way your gains compound tax-deferred.

- Also hold high-yield stocks, TIPS, REITs and taxable bonds in your retirement account. Otherwise, you’ll owe taxes on the dividend and interest payments each year

- Outside your retirement account, hold winners for at least a year. This way you’ll qualify for more favorable long-term capital gains tax treatment.

- At the end of each year, offset realized capital gains with realized losses. You can buy the losing security back after 30 days.

- In your taxable accounts, favor individual stocks, equity index funds and municipal bonds. These allow you to control – or avoid – taxes.

8. Follow strict buy and sell criteria.

You should have a checklist for every security you buy and an ironclad discipline for every one you sell.

For example, if you are a growth investor, you shouldn’t put a dime into a stock until you see competitive products, rising market share, strong sales and earnings growth, a high return on equity, and good margin protections (like patents, trademarks and copyrights).

If you are a value investor, you should insist on a sustainable business model, plenty of recurring revenue, a low price-to-earnings ratio or price-to-book value, a high margin of safety, and a sustainable dividend with a reasonable payout ratio.

When do you sell? Only when certain conditions are met. In my Oxford Communiqué Oxford Trading Portfolio, for example, we use a 25% trailing stop. Whenever a stock pulls back 25% from its closing high – or our original entry price – we sell.

This protects our profits in the good times and conserves our principal in the not-so-good ones.

9. Hold realistic expectations

Have you ever met someone gung-ho on a new diet and fitness regimen?

They will tell you that they’ve given up pasta, bread and other carbs. They will drink alcohol only on the weekends. (And then just a glass of wine with dinner.) They will go to the gym five times a week. And so on.

What happens? A month later, they tell you they gave up. It was too hard.

But the real problem was unrealistic expectations.

You want to lose 22 pounds in a year? Forget about working miracles. Lose an average of one ounce a day. One ounce. Over 365 days, that equates to 22.8 pounds.>

That’s realistic because ice cream is still on the menu. (Just not the chocolate waffle cone.)

The same is true of investing. Apply proven principles that work day after day and your molehill will turn into a mountain. All you need is time.

10. Recognize the enemy in the mirror.

My colleague Bill Bonner, head of The Agora, has a saying: “Investors don’t get what they want. They get what they deserve.”

That pithy remark encapsulates everything I’ve said in this list.

Stock market investors want to buy low and sell high. But how can you do that if you get interested in stocks only when it’s late in a bull market and valuations and complacency are high? Or if you sell in a panic every time there is a correction or bear market?

It’s tough to control your emotions when your life savings are at stake. It’s only human to feel excitement or hope or fear or greed. But it’s not smart to act on them in your investment portfolio.

Successful investors have a plan. And they stick to it.

Investment success doesn’t accrue to those with the biggest brains, but to those with the strongest stomachs.

No one knows with any certainty what the future holds.

But history shows that if you abide by these 10 proven principles, your portfolio can withstand all the bullets that will eventually come your way.

Good investing,

Alex