Finding small cap companies that pay dividends is no easy feat. At this stage in a company’s growth trajectory, cashflow is usually either too erratic or immediately put into growing the company.

However, there are those rare small cap jewels that offer dividends, and some yields are in the double digits.

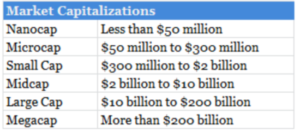

But first, let’s define exactly what a small cap stock is…

Know Your Caps

The financial industry traditionally uses small cap, midcap and large cap to describe and classify companies. But as the investments have become increasingly specific, so have the definitions. These have expanded to include nanocaps, microcaps and megacaps.

To calculate a company’s capitalization, simply multiply the share price by the number of shares it has. For example, a company with 10 million shares that are trading at $50 has a capitalization of $500 million – making it a small cap. You can find this information through Google Finance or any other stock quote site.

Compared with large cap stocks, small caps are not as well known. Nor are they as widely covered by Wall Street analysts. This allows individual investors the opportunity to find hidden profit potential in lesser-known companies.

Small caps have a history of being some of the first stocks to move upward in a new bull market. Their size enables them to react, make changes and return to profitability faster than a large company can.

Imagine a large cap or megacap company as an oil tanker and a small cap company as a speedboat. You can picture how easy it would be for the small boat to change direction and how hard it would be for the big tanker.

But please note, small caps are more volatile and run into more problems during economic rough patches. As the saying goes, “More risk equals more reward.” Just don’t forget the risk part of that saying if you don’t have a stomach for price swings.

Now, where were we? Oh yes, small cap dividend payers…

Diamonds in the Rough

Aside from master limited partnerships (MLPs) and real estate investment trusts (REITs), there are only a handful of small cap stocks that have double-digit yields.

In fact, of the more than 1,227 stocks with market caps between $300 million and $2 billion, 1,155 pay dividends. If you want a meaningful dividend yield – let’s say 5% – that decreases to fewer than 190. And if you want a double-digit yield, you are left with just 59 stocks.

The reason there are very few small cap stocks paying dividends isn’t a mystery. Smaller companies usually pour any excess cash back into the business to help it grow rather than distribute it back to shareholders.

So it’s no surprise that typical investors buy small cap stocks for capital appreciation and big gains. Very rarely are they sought for dividend income.

But that doesn’t mean it’s impossible to grab the best of both worlds.

There is a way to load your portfolio with outstanding profit potential and generate income too.

Digging for Discounted Dividend Stocks

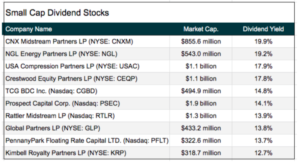

Below we have listed the top 10 small cap dividend stocks. But being under the radar and paying dividends aren’t the only requirements for our list…

For those discount shoppers out there, we have also focused on small cap stocks that have an exceptionally high dividend yield so you can collect higher than average income. Here they are…

As you can see in the list above, smaller stocks can deliver high-yielding income payouts that more than rival the typical blue chip dividend-paying stock. These small cap stocks give you exposure to oversized capital gain potential complemented by nice-sized income payments.

Just remember that small caps are usually speculative and volatile, but often outperform their bigger brethren. Small caps with big yields are rare, so consider these names a starting point for further due diligence

Good investing,

Kristin Orman

Director of Research

Liberty Through Wealth