Alexander Green is an analyst, author and speaker whose primary mission is to show investors how to achieve and maintain financial independence. For 16 years, he worked as an investment advisor, research analyst and portfolio manager on Wall Street. He has been the Chief Investment Strategist of The Oxford Club since 2001. He has written several New York Times bestsellers, including The Gone Fishin’ Portfolio, Beyond Wealth, The Secret of Shelter Island and An Embarrassment of Riches.

Alexander Green is an analyst, author and speaker whose primary mission is to show investors how to achieve and maintain financial independence. For 16 years, he worked as an investment advisor, research analyst and portfolio manager on Wall Street. He has been the Chief Investment Strategist of The Oxford Club since 2001. He has written several New York Times bestsellers, including The Gone Fishin’ Portfolio, Beyond Wealth, The Secret of Shelter Island and An Embarrassment of Riches.

In addition to directing The Oxford Communiqué (as well as The Oxford Communiqué Pro), he oversees three fast-paced VIP Trading Research Services: Oxford Microcap Trader, The Momentum Alert and The Insider Alert. He also writes for Liberty Through Wealth, a free e-letter focused on financial freedom that has more than 200,000 subscribers.

A few questions need to be answered before we dig in…

Do you like seeing a huge bill on Tax Day?

Are you a highly skilled analyst or trader?

Can you compete with big money and Wall Street when it comes to trading?

Do you enjoy watching your trading account all day, every day?

If you answered “no” to any of these questions, you should become acquainted with passive investing.

This is an investing strategy that requires almost no effort – but still generates incredible wealth for your retirement.

And luckily, we have exactly what you need to become a successful passive investor in this free report.

As you continue reading, you will learn a simple “hands-off” investing strategy with minimal risk that anyone can use.

It’s so powerful, it won a Nobel Prize.

And at the end of this report, you’ll receive an entire passive investing portfolio – completely free. (Including the ticker symbols and exact allocation percentages!)

The best part is, you don’t have to be glued to your computer or be an investing expert to start using this strategy today.

All told, it will take you about 30 minutes to set up – and then only about 15 minutes each year to maintain.

The direct inspiration for this strategy comes from the bestselling book The Gone Fishin’ Portfolio, written by investing superstar Alexander Green. (More on him to the left).

Without further ado, allow me to introduce the easy-going mentality that comes with the “Hands-Off” Portfolio.

The Passive Investing Portfolio of Your Dreams

As its name implies, the “Hands-Off” Portfolio embraces a passive investing style.

In a nutshell, a “passive (or index) investor” wants only to match benchmark returns at the lowest possible cost. Passive investments often track an index like the Nasdaq 100. When a stock is added to or removed from the tracked index, the index fund automatically buys or sells that stock.

In contrast, an “active investor” believes that he or she can regularly generate (or choose fund managers who can generate) returns that are above those of a specific benchmark. Active management aims to outperform indexes like the S&P 500 or other benchmarks. Every fund manager chooses a benchmark that contains the type of investments their fund contains.

Why Are Benchmarks Important?

Benchmarks are indexes created to include multiple securities representing some aspect of the total market. Benchmark indexes have been created across all types of asset classes. In the stock market, the S&P 500 and Dow Jones Industrial Average are two of the most popular large cap stock benchmarks.

In fixed income, examples of top benchmarks include the Barclays Capital U.S. Aggregate Bond Index, the Barclays Capital U.S. Corporate High Yield Bond Index and the Barclays Capital U.S. Treasury Bond Index, to name a few.

When looking at the performance of any investment, it’s important to compare it against an appropriate benchmark.

Based on the name alone, you may assume that an active investing style would generate better returns.

Fortunately, a study published by Vanguard strongly supports the passive management approach.

Vanguard’s investment counseling and research group tracked 420 actively managed balanced funds that had at least five years of returns.

Only 7% outperformed their benchmarks. That is not great.

And before you think all you need to do is invest in funds whose managers have done well over the past five years, academic studies have found that mutual funds underperform passive benchmarks over multi-year periods.

According to Index Fund Advisors, “A growing sense of buyer’s remorse by traders should not come as a surprise.” A host of academic and industry research points to a horrible tendency of active investors: They panic and bail out at just the wrong times.

Are you still not convinced that passive investing is a better approach?

Fidelity reviewed the performance of its customers from 2003 to 2013 and found that the best returns were from customers who were either dead or inactive.

Can’t get much more passive than DEAD!

Ultimately, there is no guarantee that active investing beats passive investing.

Not to mention that the expenses involved with active investing can add up quickly!

Given all that…

Adopting a passive strategy is the way to go.

Staying on the Path to Financial Freedom

With any investment program, there are two obstacles that could impact your ability to build wealth: taking too little risk and taking too much risk.

Some investors are too timid for their own good. Being conservative with your investments and avoiding risk might seem attractive. But if you’re too conservative and your returns do not increase your purchasing power after taxes and inflation, you’ll likely fail to meet your investment goals.

The flipside to this is taking too much risk.

Instead of being cautious, you end up letting it all ride with risky investments. Assuming too much risk puts you in a situation where you could end up losing all or a substantial percentage of your investment capital.

But that’s where the asset-allocated “Hands-Off” Portfolio can help.

It’s designed to make sure you take on just the right amount of risk. It provides you with a balanced investment portfolio that ensures you will meet your investment goals and be able to retire as planned.

How does it do this?

The “Hands Off” Portfolio makes use of very low-risk investments. And it combines them with high-returning investments that keep your overall volatility low. It’s this low-risk aspect that appealed so greatly to the Nobel Prize committee.

And this strategy will help ensure a future of financial security. You’ll be able to live with peace of mind, knowing that your retirement is safe.

Let’s dig into one of the most important aspects of the strategy… asset allocation.

Asset Allocation: Different Investment Baskets Can Make You Less of a Basket Case

So what is asset allocation? Let’s run through the basics…

Asset allocation’s roots can be traced back to the 1950s, when a University of Chicago graduate student, Harry Markowitz, began his dissertation on the stock market. He developed a theory and a mathematical framework that would become the foundation of financial economics. Years later, with William Sharpe, Markowitz was awarded the Nobel Prize in Economics for his pioneering work on modern portfolio theory… which is now referred to as asset allocation.

Asset allocation is the process of developing the most effective mix of investments.

In other words, it is breaking down your portfolio into different classes of investments to maximize returns and minimize risk. As the familiar cliché goes, “Don’t put all your eggs into one basket.” In the world of asset allocation, this is the key to unlocking maximal returns with minimal risk.

Let’s begin with the first steps in breaking down your portfolio into baskets, or asset classes. Below, you will see how The Oxford Club recommends breaking down your portfolio.

An asset class is a group of securities that have similar financial characteristics. Today, there are many to choose from. For the purpose of this report, let us focus on the five principal types of long-term investments: stocks, bonds, cash, real estate and precious metals.

Within them, there are also many subclasses (more on that to come).

Bottom line: Proper asset allocation involves the selection of investments across many asset classes to maximize returns and minimize risk.

Diversification and Correlation… Limiting Assets That Behave the Same

Diversification is a strategy designed to reduce risk by combining a variety of investments that are unlikely to all move in the same direction at the same time.

The goal of diversification is to reduce a portfolio’s volatility. Diversification ultimately reduces both the upside and downside potential of your portfolio. As a result, it allows for more consistent performance under a wide range of economic conditions.

In today’s markets, consistency is something most investors would gladly welcome.

We need to be clear, though… Asset allocation is not just diversification. A portfolio can be properly diversified based upon only 10 stock holdings, but only if they are spread out among different classes – like the “Hands Off” Portfolio.

The advantage of asset allocation is that it allows you to invest a portion of your capital in higher-risk assets while placing another portion in lower-risk assets.

The actual mix of asset classes you’ll want to use depends on your risk tolerance, which may change over time. How you allocate your portfolio today may be different from how you allocate your portfolio 10 years from now.

For example, bonds are lower-risk than stocks – and lower-reward. So as you get older, you may want to shift a larger percentage of your portfolio into bonds to help protect yourself – and your retirement – in the event of a market pullback.

That said, the “Hands-Off” Portfolio is a great place to start for investors of all ages.

Passive investing guarantees the lowest expenses and, luckily, the “Hands-Off” Portfolio allows you to put this strategy to work through the lowest-cost group of mutual funds in the country, the Vanguard Group.

Now, what we’re about to show you is usually reserved for paying subscribers.

But as promised, we’re giving this portfolio away – along with specific allocations – absolutely free.

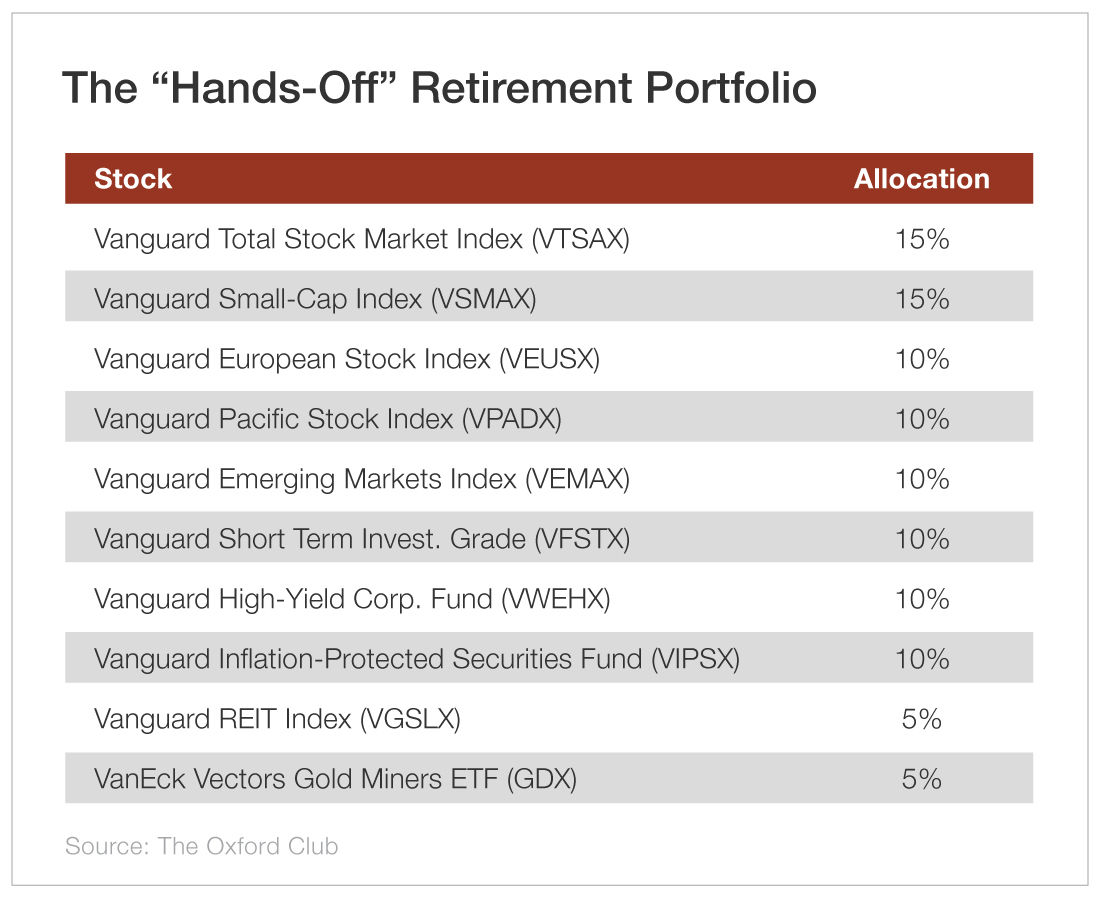

Here is how you would asset allocate according to our “hands-off” model:

Notice that our allocation to U.S. stocks is divided between small and large cap stocks. Likewise, the 30% allocation to international markets is evenly divided between Europe, the Pacific and emerging markets.

It is important to note that the “Hands-Off” Portfolio is not exclusive to the Vanguard Group. Alex selected Vanguard to use for our family of funds simply because it has the lowest expense ratios. To maximize returns through asset allocation, reducing expenses with the Vanguard Group provides the best platform.

But this doesn’t mean you cannot apply the same strategy to a different group of funds. Asset allocation can be used with any fund family (Fidelity, T. Rowe Price, etc.). You can apply these concepts to your 401(k) or any other account that has a limited selection of funds.

Simply use the same percentage breakout. Then select the ones that most closely mirror the Vanguard funds from the list of funds available to you. Your expenses might be slightly higher, but you will still be able to benefit from guaranteed maximized returns and minimized risk thanks to asset allocation.

After using asset allocation to divide investments across different asset classes, there is one more critical component to understand: the 15 minutes of work you’ll have to do annually, known as rebalancing.

The Rebalancing Act: “Buy and Hold” Is Not an Investment Strategy

Any successful investment strategy must include a sell discipline. Otherwise, you are just acting blindly.

Admittedly, the decision to sell is complicated. History proves it’s impossible to predict which asset class will be the best or the worst performing in any given year.

This means you must remain allocated across a broad group of asset classes. That’s why proper asset allocation also involves rebalancing.

Rebalancing helps you maintain your target allocation by selling a portion of an appreciated asset and investing the proceeds into an underweighted asset class to restore your original asset allocation. To understand this, consider the following…

Every asset class in the “Hands-Off” Portfolio – stocks, bonds, precious metals, etc. – represents a specific percentage of your total portfolio.

But as each year goes by, those percentages change depending on the performance of the financial markets. For example, bonds may be higher, and stocks may be lower.

The job of rebalancing is to bring those percentages back into your original alignment.

This is also where your sell discipline comes into play.

Instead of the “buy and hold” philosophy, asset allocation forces you to sell investments on an annual basis. And the ideal candidates to replace them are the assets within that same asset class that performed the worst during the previous year.

Remember, you want to buy low and sell high. And this strategy forces you to do so. That’s a good thing.

If you don’t rebalance, you’ll be buying more of an appreciated asset in the hope that you can sell it at an even higher price in the future.

Again, it is impossible to predict which asset class will be the best- or worst-performing in any given year. Rebalancing your portfolio ensures your investments are always properly allocated to take advantage of these year-to-year changes.

Research from Ibbotson Associates demonstrates that the strategy of rebalancing reduces the level of portfolio risk in both market upturns and downturns. More importantly, Ibbotson found that the reduction in risk is greater during market downturns.

So when markets are performing poorly, your rebalanced portfolio will experience fewer negative returns than if you hadn’t rebalanced – leaving you with more money to take advantage of the upswing than you would have otherwise.

Who Should Consider the “Hands-Off” Portfolio?

For those of you who are conservative investors, who are retired or close to retirement, or who need to exceed inflation while taking as little risk as possible – and want to spend your time doing the things you actually want to do – the “Hands-Off” Portfolio is designed with you in mind.

And for investors who need their returns to exceed inflation, this is the ultimate strategy in risk reduction.

The goal here is not to beat the market by the largest margin in the shortest period of time.

Rather, this portfolio gives you and your family a gift that may be more valuable still: peace of mind. And at the same time, it is guaranteed to maximize your returns and minimize your risk.

Looking for High Returns?

To be frank, however, it is not the ultimate portfolio for generating high returns.

Our Oxford Trading Portfolio, for instance, has generated market-beating returns year after year. Many of the portfolios in our VIP Trading Research Services at The Oxford Club have done even better.

For those of you who need to maximize returns – either because you started saving late in life or need to post big numbers in a short period of time – following our individual investment recommendations is a more effective shortcut to success.

The best way to do get started is through Alexander Green’s newsletter The Oxford Communiqué.

Alex’s readers can leverage the power of three other investment strategies besides just the Gone Fishin’ Portfolio, which the “Hands-Off” Portfolio is directly modeled after. In total, the Communiqué has FOUR portfolios, all filled with top-tier recommendations you can leverage to your advantage.