Many Oxford Club Members readily embrace the label of “value investor.”

Analyzing balance sheets, income statements and cash flows is all about understanding how to invest your hard-earned wealth.

Moreover, it’s hard to argue with success. Value investing helped make Warren Buffett one of the wealthiest men in the world…

After all, value investing is all about buying cheap stocks.

And who doesn’t like a good deal?

In short, value investing is sober, serious and respectable.

In contrast, you may be deeply suspicious of momentum investing.

Investing based on the financial markets’ latest mood swing seems superficial.

It’s an approach that seems better suited for gamblers than serious investors.

That’s too bad.

Plenty of academic research confirms that a disciplined momentum investing strategy works surprisingly well.

So even if you’re a hardcore value investor, bear with me as I make a case for momentum investing…

Momentum Investing Explained

The essence of momentum investing is simple.

You have probably observed that once a market starts to rise (or fall) it tends to keep going in that direction.

Put another way… the trend is your friend.

Studies based on decades of data have confirmed that momentum stocks tend to outperform the broader stock market.

Academics at Cambridge Judge Business School and London Business School found over time that U.S. stocks that had beaten the market in the previous 12 months returned an average of 17.5% a year, compared with a 9.5% annual return by the market’s laggards.

Beating the market by eight percentage points a year on average is nothing short of astonishing!

The study’s authors called the results “vaguely embarrassing.”

It turns out that merely acknowledging the success of momentum investing in academia is “politically incorrect.”

Why Is Momentum Investing Unpopular?

Value investors cringe when they hear the word “momentum.”

The very suggestion that a strategy as simplistic as momentum investing could work is an insult to their hyper-rational approach.

The success of momentum investing is also a fly in the ointment of modern financial theory.

That’s because it flies in the face of the efficient market hypothesis (EMH).

The strongest version of the EMH asserts that a stock’s current price reflects all known information about it.

As such, the market should price all stocks to perfection.

To their credit, even the fathers of EMH – Eugene Fama and Kenneth French – recognized the challenge posed by momentum investing:

The premier market anomaly is momentum. Stocks with low returns over the past year tend to have low returns for the next few months, and stocks with high past returns tend to have high future returns.

Why does momentum investing make academics feel so queasy?

I believe there are two reasons.

First, value investing takes both smarts and hard work.

You have to analyze financial statements, meet with management and evaluate a business’s prospects.

All of this requires a unique blend of academic knowledge and practical experience.

In contrast, momentum investing is simplistic and mechanical.

It’s more akin to an elaborate game of musical chairs where the players are vying for a seat before the music stops.

Momentum investing also relies on understanding investor psychology.

Unlike the perfectly rational “homo economicus” (economic man) you find only in finance textbooks, most investors are driven by FOMO – the fear of missing out.

Momentum investors profit from the distortions of the short-term psychology of the stock market.

Unlike academics, they care less about abstract theory and more about real-world investor behavior.

Challenges of Momentum Investing

Still, few investors trade purely on momentum.

That’s because momentum investing is simple in theory. But it’s not easy in practice. Here’s why…

First, momentum investing is a high-turnover, high-cost strategy. You have to spend a lot of time sitting in front of a screen to make it work.

Second, momentum stocks can reverse swiftly. And that extracts a high psychological toll.

Third, like any other strategy, momentum investing doesn’t work all the time.

The bottom line?

Momentum strategies work because we are not perfectly rational creatures. And momentum is ultimately a reflection of the underlying psychology of financial markets.

So how can you profit from these insights?

The good news is you don’t need to cook up a homemade momentum strategy.

Instead, you can invest in one of a handful of momentum exchange-traded funds (ETFs).

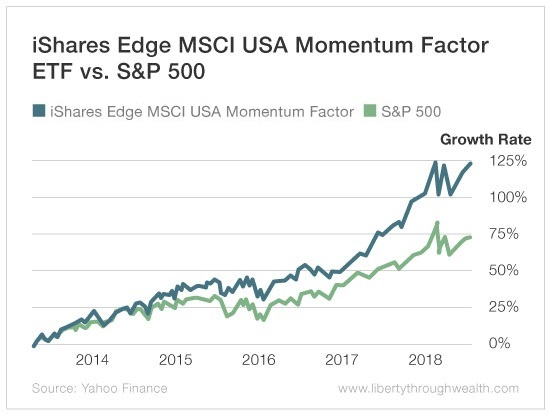

I recommended the iShares Edge MSCI USA Momentum Factor ETF (BTC: MTUM) to attendees at the 20th Annual Investment U Conference this year.

This five-year-old fund has trounced the S&P 500 since its inception and is rapidly becoming a benchmark among momentum investing strategies.

So buck the conventional wisdom and embrace the label of becoming a “momentum investor.”

You’ll be glad you did.

Good investing,

Nicholas

P.S. Value investors… let me know if I’ve managed to change your mind about momentum investing by commenting below.