Last week we had you envision your retirement nest egg in a healthy, happy place (perhaps it already is).

Last week we had you envision your retirement nest egg in a healthy, happy place (perhaps it already is).

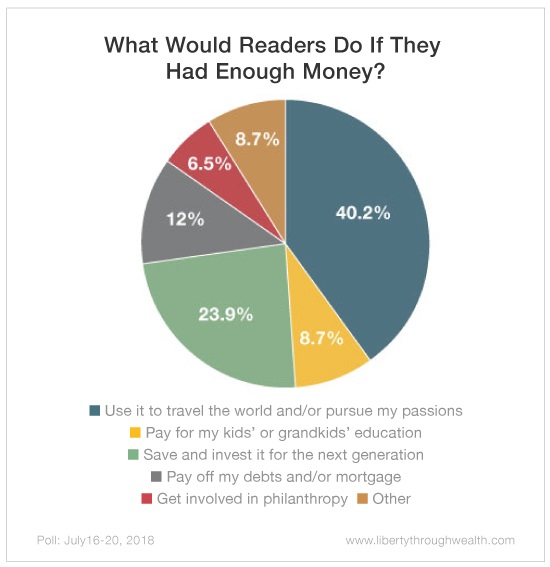

So we asked – after meeting your living and health care expenses, what’s the very next thing you would do with your wealth?

About 40% of you feel like it’s time to care for your personal needs and wants by pursuing your passions. And there’s nothing wrong with that at all. You’ve likely sacrificed your entire life to pay your mortgage, raise kids, put food on the table, work long hours to get promoted – if anyone deserves to let loose and have some fun, it’s you!

But another 40% of you were feeling slightly more altruistic. You have a primary desire to invest and pass your wealth on to future generations, help your kin out with educational costs, and donate to charity.

Of those who wrote in, most of you couldn’t decide between following your passions and investing in the next generation, so you chose both.

According to a recent study by Accenture, $30 trillion (yes, that’s trillion with a “T”) in assets will pass from baby boomers to their relatives over the next 30 to 40 years. Unfortunately, 70% of those wealth transfers are doomed to fail by the time they make it to the second generation.

Why? Most of us who inherit money are not prepared to manage it. Rather than invest and let it compound, we’re tempted to use it to pay off looming debts, buy new toys, take exotic vacations… you name it.

If you’re worried this could be your relatives, take some time to talk about what you’d like seen done with your money – and don’t be shy about putting it in writing. This way, there’s no family infighting when it comes time for wealth transfer. Everyone should be on the same page… and know exactly what their marching orders are.

After all, the pen is mightier than the sword.

Good investing,

Donna