A few years ago, the doom-and-gloomers held sway over the media.

“Permabears” like Nouriel Roubini (known as “Dr. Doom”) and gold bugs like Peter Schiff dominated the financial airwaves.

Other analysts even predicted the “end of America.”

The doom-and-gloomers’ predictions seemed as inevitable as night following day.

Today, 10 years after the collapse of Lehman Brothers, it’s time to call their bluff.

Since 2008, the American economy has done more than just step back from the precipice of collapse.

It’s recovered strongly. American companies have continued to innovate and thrive…

And the U.S. stock market has enjoyed a stunning run.

The U.S. vs. the World

As a global investor, I keep a close eye on the performance of foreign stock markets.

Specifically, every day I track 44 global stock market exchange-traded funds (ETFs) on my proprietary Money Matrix that stretches across two computer screens on my desk.

And here’s what that Money Matrix told me as of this morning…

The U.S. stock market – as measured by the Vanguard Total Stock Market ETF (NYSE: VTI) – has gained 18.9% over the past 12 months.

This makes it the No. 1 global stock market performer during that period.

If we look back further, the Total Stock Market ETF’s track record is even more impressive.

Over the past five years, it’s ranked No. 1 among the global stock markets I track, with an average annual gain of 13.3%.

Over the past decade, it’s ranked No. 2, generating an average of 11.8% per year.

So how did the U.S. stock market dominate all other rivals so clearly and consistently?

As it turns out, the driver of U.S. stock market performance comes down to a not-so-secret weapon…

U.S. technology stocks with a uniquely global reach.

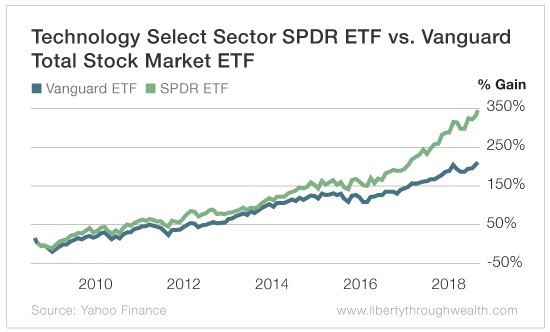

Just look at how the Technology Select Sector SPDR ETF (NYSE: XLK) has performed against the broader-based Total Stock Market ETF.

As the chart above confirms, the technology sector outperformed the broader U.S. market by a whopping 136% over the past 10 years.

Let’s put the U.S. tech sector in a global perspective…

Japan is the world’s third-largest economy. And the “traditional” U.S. technology sector today is worth more than the entire Japanese stock market. (This number excludes technology-related companies like Facebook, Amazon and Netflix.)

The combined market cap of Silicon Valley’s top six traditional tech companies alone – Apple, Alphabet (parent company of Google), Intel, Oracle, Cisco and Nvidia – is $2.7 billion.

That makes them worth more than the stock market of Germany – and Germany is the world’s fourth-largest economy.

So what’s the secret behind the remarkable success of the U.S. tech giants?

On the one hand, they are just U.S.-based companies listed on U.S. stock exchanges.

But on the other, they are global giants that dominate much of the global tech industry.

And the extent of that dominance is breathtaking.

Google accounts for 3.5 billion searches per day, or 1.2 trillion searches per year.

Facebook boasts 2.2 billion users all across the planet.

Amazon dominates U.S. e-commerce with a 49% market share, equivalent to 5% of all U.S. retail sales.

Uber has booked more than 10 billion rides so far.

Airbnb has more than 5 million listings across more than 81,000 cities and 191 countries.

Is This Time Different?

Now, I’m always instinctively skeptical when investors start gushing in such superlatives.

So the question arises…

Will the current U.S. tech boom end in tears?

My answer is…

One day, perhaps, yes.

But today, there is little sign of an imminent collapse.

Yes, social media stocks like Facebook may be fraying at the edges. Amazon is being dragged in front of Congress, forced to apologize for its success. And tech giants Microsoft and Google are battered relentlessly by European regulators.

Still, U.S. tech giants are hardly partying like its 1999 and burning through speculative money.

Instead, they’re sitting on oodles of cash…

And they aren’t tremendously overvalued. The sector’s forward price-to-earnings ratio is barely above its 25-year average of 18.7.

So to summarize…

American technology giants have been responsible for the U.S. stock market’s world-beating performance over the past decade.

More importantly, this trend is likely to continue.

That’s because today’s American tech giants are moneymaking machines…

And reasonable valuations hardly signal a financial mania.

Even Warren Buffett – who famously sat out the dot-com boom – is getting on board… he now holds more than $50 billion in Apple stock.

American technology companies represent a secular change in both the way we live our lives and how we invest.

So ignore the permabears…

And don’t miss out on this powerful tech megatrend in the decades to come.

Good investing,

Nicholas