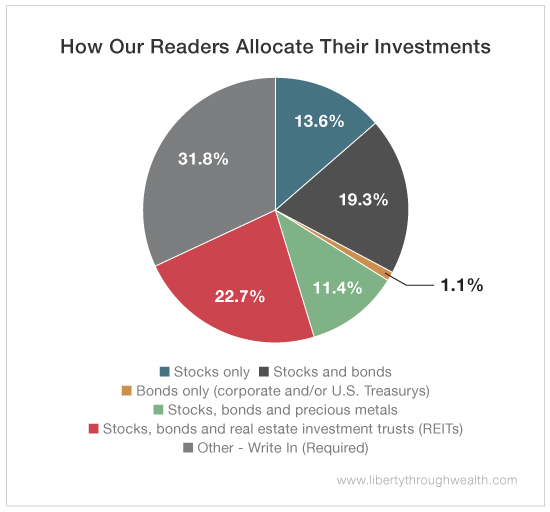

The week of September 10, we asked Liberty Through Wealth readers how their investment portfolios are allocated.

Our data shows that 56% of those who participated in the survey invest in multiple asset classes (stocks, bonds, exchange-traded funds, real estate investment trusts, etc.). That leaves 44% who invest in only one or two asset classes.

What’s surprising is that only 9% of those polled follow the asset allocation model recommended by The Oxford Club’s Chief Investment Strategist Alexander Green. That means that 91% of you aren’t getting as much money as you could from your investments.

Although asset allocating may not be as exciting as trying to pick the next Amazon, it’s an easy way to manage risk and maximize reward.

According to Alex, investing in a single asset class like stocks is not adequate diversification. The more asset classes you invest in, the less volatile your portfolio will be.

At the same time, dividing your money between the different asset categories isn’t enough either. You also need to diversify your investments within each asset class. In the bond category, for example, there are government and corporate bonds, high-grade and high-yield bonds, etc.

By diversifying between and within asset classes, you’ll stabilize your portfolio, balance your risk and cover your bases.

Good investing,

Katherine