We’ve all heard it: When life hands you lemons, make lemonade. But what if the lemons are bruised, shriveled and tiny? Do you still make lemonade? Or do you run back to the market to buy more?

This is the pickle investors deal with regularly. When the markets are up, they turn opportunities into great wealth. But when the markets are down, it’s harder to say when you should stick it out or pack it in.

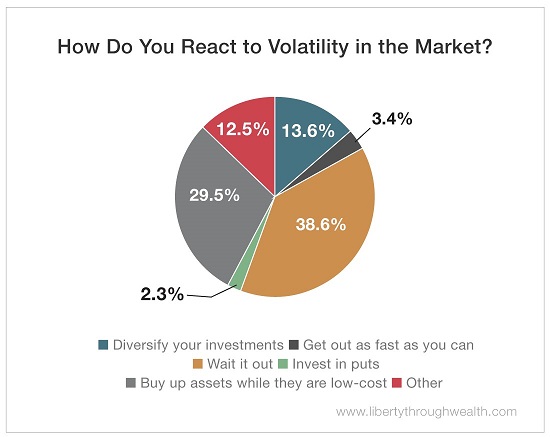

Last week, we asked what you do when there’s volatility in the market… And your answers were pretty savvy…

In fact, 39% of you report that you wait out unstable markets. Another 30% take it a step further and buy up additional assets while they’re undervalued.

In other words, you stay calm, cool and collected.

Famed investor Warren Buffett recommends sticking to your investment strategy regardless of what the markets are doing.

ETF Strategist Nicholas Vardy agrees. Since corrections are “a normal part of investing,” you need to keep calm and carry on.

And Chief Investment Strategist Alexander Green strongly believes that trying to time the market – be in when the market’s up and out when the market’s down – is a deeply flawed investment approach. Not only that, but it will lose you money in the long run.

If you get nervous during a market downturn, Alex suggests reallocating your investments. If you have no problem watching the market go down a little, use the opportunity to buy assets while they’re cheap.

The bottom line? Lemons are always in season somewhere. So keep making lemonade.

Good investing,

Katherine Koman, Assistant Managing Editor