“Smart beta” exchange-traded funds (ETFs) are hot.

Investors plowed $77.6 billion into smart beta ETFs in 2018.

And 145 managers launched 499 new smart beta ETFs the same year.

In stark contrast, plain-vanilla market cap-weighted ETFs saw a 30.5% drop in net inflows last year.

These statistics confirm what I’ve written before: Smart beta ETFs threaten the very existence of the hedge fund industry.

After all, why pay the exorbitant fees for hedge funds when smart beta ETFs deliver better returns at a lower cost?

What Are Smart Beta ETFs?

In their early years, ETFs simply tried to emulate the success of traditional index funds.

Much like the index mutual funds pioneered by John Bogle at Vanguard, market cap-weighted ETFs track traditional indexes like the S&P 500 and Nasdaq.

Now, there’s nothing wrong with market cap-weighted ETFs.

After all, an ETF like the Vanguard Total Stock Market ETF (VTI) provides a low-cost, convenient and transparent way of tracking market returns.

But if you’re the kind of investor who wants to try to beat the market…

Then ETFs tracking traditional market cap indexes guarantee you’ll fall short.

In contrast, smart beta ETFs offer a novel, disciplined and, most importantly, profitable alternative.

Now, remember that all smart beta ETFs are also technically index funds.

But they track “alternative indexes” that invest in stocks based on factors other than market capitalization – factors based on familiar strategies like value, momentum or insider buying.

Of course, not all smart beta ETFs deliver market-beating returns each and every year.

Still, on average, a smart beta ETF can add between 1% and 2% to your annual returns…

That may not seem like much at first.

But thanks to the miracle of compound interest… That small difference compounded over time will make a massive difference in your net worth.

A Dynamic Growth ETF Trouncing the S&P 500

To illustrate the power of smart beta investing…

Let’s pop the hood on the Invesco Dynamic Large Cap Growth ETF (NYSE: PWB).

As its name suggests, it is a pure large cap growth fund.

Unlike strategies that invest in beaten-down value stocks, growth strategies are all about investing in tomorrow’s big winners today.

Think of a stock like Netflix (Nasdaq: NFLX) where even a small investment a decade ago would have set you well on your way to financial independence.

The Dynamic Large Cap Growth ETF offers a disciplined approach to growth stock investing by tracking the Dynamic Large Cap Growth Intellidex Index.

Specifically, the Intellidex Index applies a rigorous 10-factor screening process to identify large cap companies with the very best growth prospects.

It screens for factors like book value, cash flow, sales and dividends.

The result is a portfolio of about 50 stocks that diverges from a traditional market cap-weighted portfolio in three critical ways.

First, the portfolio tilts toward the smaller side of the large cap space.

After all, it’s easy for smaller companies to grow faster than larger ones.

Second, the portfolio makes some significant sector bets.

The two largest sectors – technology and healthcare – account for a whopping 56.2% of its holdings.

Finally, the most crucial ingredient of the Dynamic Large Cap Growth ETF’s “secret sauce” may be how it weights the stocks it invests in.

It allocates 50% of its assets equally to the 15 largest companies by market cap. It then allocates the other 50% equally to the remaining 35 holdings.

The result is a concentrated portfolio with the top 10 holdings accounting for about 35.3% of the ETF’s holdings.

This approach has delivered some eye-popping results.

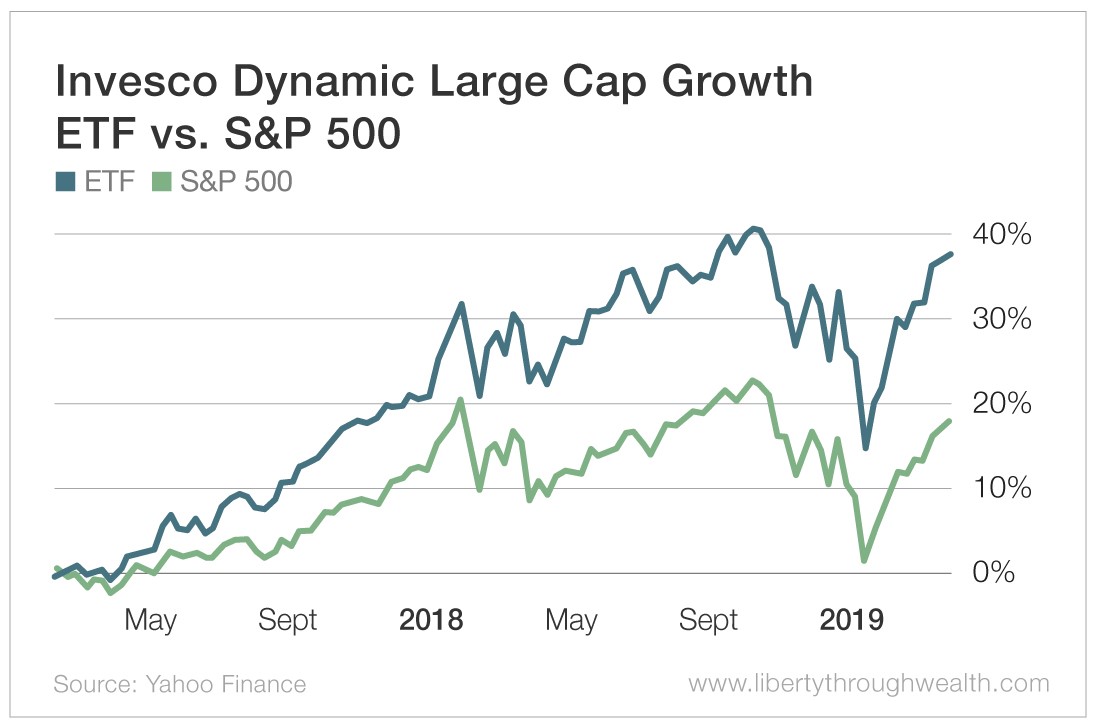

Over just the past two years, the Dynamic Large Cap Growth ETF has more than doubled the return of the S&P 500.

With its top three holdings in Boeing (NYSE: BA), Facebook (Nasdaq: FB) and Nike (NYSE: NKE), it has generated these market-trouncing returns by investing in household names… and not in a portfolio of high-risk, small cap stocks.

Since mid-December, the Dynamic Large Cap Growth ETF is up 12.1% (including dividends), trouncing the S&P 500’s 8.6% gain over the same period.

These market-beating returns make this ETF’s relatively high annual operating expenses of 0.6% a bargain.

The bottom line?

The market-beating performance of the Dynamic Large Cap Growth ETF confirms why you should invest in smart beta investment strategies…

And highlights why growth investing is one of the 10 core strategies in my Oxford Wealth Accelerator Strategic Portfolio.

Good investing,

Nicholas