Few business tycoons of the last 50 years loom larger in American business lore than Steve Jobs and Warren Buffett.

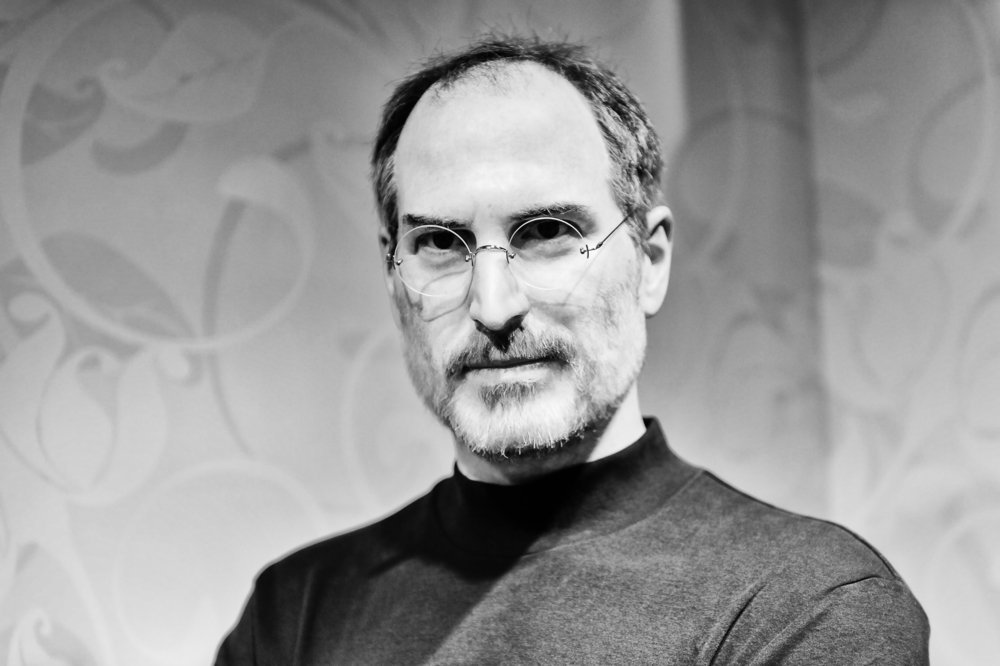

Although he passed away 11 years ago, Jobs, the founder of Apple (Nasdaq: AAPL), remains a household name among investors.

And the 91-year-old Buffett still fills stadiums at Berkshire Hathaway’s (NYSE: BRK-B) annual meetings, where he imparts his pearls of investment wisdom.

So here’s a question that popped into my mind last week as I reread the biographies of these two titans of American business.

Who has had more influence on American business – Jobs or Buffett?

Based on accumulated wealth, Buffett wins hands down.

Even after the recent 23% pullback in Berkshire stock, he still boasts a net worth of $96 billion.

Meanwhile, Jobs died in 2011 with a fortune valued at just $10.2 billion.

For Buffett, a former paperboy in Omaha, money was always about keeping score.

In contrast, Jobs cared only about making “a dent in the universe.”

And that difference is what made all the difference.

Steve Jobs: The Quintessential Silicon Valley Success Story

Born in 1955 and given up for adoption by his birth mother, Jobs grew up in Northern California’s Silicon Valley.

The Silicon Valley of the 1960s and 1970s was a good fit for Jobs.

At the time, Silicon Valley was a curious mix of hippie-inspired counterculture and engineering geekiness.

Jobs was equally fascinated by the insights of his LSD trips, clean design and the calligraphy he studied during his one year at Reed College.

Jobs launched Apple in 1976 in his parents’ garage with an investment of just $1,300.

Every Batman needs a Robin. So Jobs partnered with Steve Wozniak – a high school friend, five years Jobs’ senior. The two cobbled together the first Apple I computer from spare parts.

By the time Jobs was 24, Apple had achieved $100 million in sales.

And by the time Apple went public in 1980, Jobs’ net worth was $250 million.

The first Macintosh (Mac) computer debuted in 1984, supported by an infamous commercial featuring Big Brother.

The Mac’s success turned Jobs into an instant business rock star.

But Jobs’ famously intolerant temperament was too much for the board of a publicly traded company.

So he was tossed out of Apple in 1985.

Through a rather improbable set of circumstances, Jobs made his way back to Apple. He became its CEO again in 1997.

Apple eventually became the most valuable company on the planet – valued at over $3 trillion at its peak.

And today, over 900 million people are addicted to their Apple iPhones. And 3 billion use Android smartphones inspired by its design.

Why Steve Jobs Would Have Been a Lousy Investor

Jobs may have built arguably one of the most successful companies of his generation, still active to this day.

But I think he would have been a flop as a stock market investor like Buffett.

First, Buffett’s style of investing requires patience. And that’s one quality Jobs sorely lacked.

Jobs would bully his employees. He would intimidate them into achieving seemingly impossible goals. His primary strength was his “reality distortion field.” Jobs pushed and pushed until reality bent to his will. That perhaps works in the world of product design.

But not even Steve Jobs could bully the stock market into doing his bidding.

Second, to be a successful investor, you must keep calm in the face of Mr. Market’s mood swings.

Well, in many ways, Jobs was a mood swing incarnate. He took his perfectionism to an extreme. That same manically obsessive approach applied to stock market investing would have crushed him.

Third, Jobs wanted to change the world.

In contrast, Buffett got rich by betting on a world that didn’t change much. Berkshire Hathaway invested in companies assuming we would live much as we did 30 years ago. We would use Gillette razors in the morning, drink Coke during the day and shop at Costco at night.

Jobs would dismiss such an approach as pointless bean counting.

Apple and Berkshire: The Surprising Connection

Let me close with an ironic anecdote.

Buffett has long been friends with Microsoft (Nasdaq: MSFT) founder Bill Gates.

Yet Buffett never bought more than a nominal 100 shares of Microsoft.

In contrast, Berkshire Hathaway’s single largest investment in any one company has been Apple.

Today, Apple accounts for well over 40% of Berkshire’s publicly traded investment portfolio.

It is by far the single most successful investment in Berkshire’s history.

And on this front, too, Jobs blew it.

Back in the mid-1980s, Jobs owned 20% of Apple.

But after he was ousted from the board, Jobs sold 99.99% of that 20% stake for a gain of $100 million.

He kept a single share to continue receiving annual reports and attend shareholder meetings.

Had Jobs never sold his 20% stake in Apple back in 1985, those shares would be worth $450 billion today.

That’s about 4.5 times Buffett’s net worth today.

My verdict?

Steve Jobs made a bigger dent in the universe.

But one of the great ironies of investment history is Buffett made far more on Apple stock than Steve Jobs ever did.

So who do you think is America’s most influential business tycoon: Steve Jobs or Warren Buffett?