At this year’s 20th Annual Investment U Conference, I posed the following question to my audience…

“What’s the most successful financial product of the last decade?”

The No. 1 answer? “Index funds.”

John Bogle, the founder of index fund giant Vanguard, has been remarkably successful in getting his message out to investors.

Yes, index funds are a terrific innovation that have changed the investment landscape for the better.

But I believe there’s been an even more important innovation in the markets.

And that innovation is exchange-traded funds (ETFs).

Let’s quickly review just what an ETF is…

An ETF is a listed security that tracks an index consisting of a portfolio of individual securities.

As with mutual funds, when you buy an ETF, you don’t pick a specific security. Instead, you choose a particular asset class, sector, theme, country or investment strategy.

With ETFs, you can invest in everything from stocks, bonds and the U.S. technology sector to Dividend Aristocrats, Russian small caps and even timber.

ETFs also offer distinct advantages over traditional mutual funds…

You can buy and sell ETFs as easily as you buy a share of Apple (Nasdaq: AAPL).

ETFs are both cheaper and more transparent. They require no investment minimums. They’re generally more tax-efficient. And you can invest in ETFs that offer leverage or even profit when markets go down.

No wonder ETFs have come to dominate stock exchanges over the past decade.

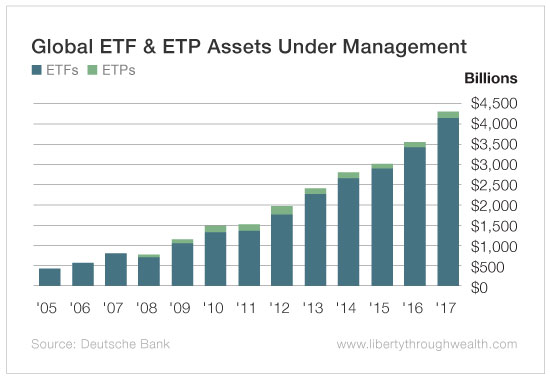

Just look at how much money investors have poured into ETFs and their cousins, exchange-traded products (ETPs), in the past 12 years…

Today, more ETFs trade on the major exchanges than individual stocks.

And ETFs now represent 25% to 30% of trading volume on any given day.

The 3 Freedoms of ETF Investing

ETFs are all about providing you with financial freedom.

They do this by helping you generate more wealth and allowing you to chart your own path… and keep more of what you earn.

1. The Freedom to Generate More Wealth

ETFs allow you to invest in ways that, until recently, were completely off-limits to retail investors.

With ETFs, you can invest in anything from artificial intelligence to cryptocurrencies to international real estate.

You can go both long and short the markets… and even use leverage. A handful of ETFs are bets on the direction of the volatility index, or VIX.

Amazingly, you can access these complex strategies at the click of a mouse.

The creativity of ETF providers seems limitless. And it’s this creativity that is the ETF industry’s most significant investment edge.

2. The Freedom From Exorbitant Fees

The fees charged by traditional mutual funds sometimes take my breath away.

Some funds still charge you a “front-end load” of up to 4.75% to invest in them. Invest $10,000 and you are $475 in the hole on day one.

Contrast this with the universe of ETFs…

Today, you can trade hundreds of ETFs at many major brokerages like Fidelity, Schwab, Vanguard and E-Trade for free. (Vanguard just eliminated fees on 1,800 ETFs.)

ETFs also charge lower management fees than a typical mutual fund. According to Morningstar, the average expense ratio for an ETF is 0.23%. (And even the most expensive ETF is cheaper than what you’d pay for buying a basket of equities individually.)

Compare ETF fees with the average actively traded mutual fund’s fee of 1.43% and you can see why cost-conscious investors prefer ETFs.

3. The Freedom to Chart Your Own Course

Having the freedom to chart your own course is perhaps the most important benefit of investing in ETFs.

Once upon a time, a financial advisor told you to invest in 60% stocks and 40% bonds. Then he would invest according to this “one size fits all” formula in products that would maximize his own personal financial kickback.

As recently as 2007, ETFs were exotic instruments used primarily by professional financial advisors.

Since then, ETFs have penetrated what George Bernard Shaw called the “conspiracy against the laity.”

Today, self-directed investors have used ETFs to take the reins of their financial affairs and run their own portfolios as they see fit.

After all, why should you allow a broker to shoehorn your portfolio into a rigid (and expensive) financial plan?

Here’s the takeaway I’d like to leave you with today…

Once you become familiar with ETFs, you’ll have the tools to custom build your own financial plan and follow your own financial light.

And you’ll be able to do so with more flexibility, lower costs and superior financial returns.

I’ll be exploring specific strategies on how to do that in future columns…

Good investing,

Nicholas