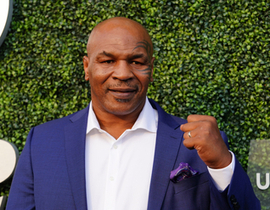

You might not think of Mike Tyson as a mentor when it comes to running your portfolio.

After all, the former undisputed heavyweight champion of the world has never demonstrated any great money management skills.

In fact, he has been a wildly controversial figure both inside and outside the ring, even biting off part of Evander Holyfield’s ear in a 1997 bout.

Yet you can pick up investment wisdom in some of the most unlikely places…

Let’s start with his “peekaboo” boxing style.

Tyson routinely placed his hands in front of his face to offer superb protection, striking out only when he saw the right opportunities.

Smart investors do the same thing.

Start in a strong defensive position. Forget about risking your hard-earned capital in dicey plays like commodity futures, penny stocks and illiquid limited partnerships. (That’s the equivalent of taking wild swings.)

You should also have an exit plan. That doesn’t mean you jump out of the ring (leave the market).

Rather it means you run a trailing stop behind every stock position, allowing yourself unlimited upside potential with strictly limited downside risk.

Tyson knew effective offense begins with a good defense.

Late in his career, Tyson also said, “I ain’t the same person I was when I bit that guy’s ear off.”

Good for him. (Personal growth means different things to different people.)

But the key in investing – and in life – is to learn along the way.

Expect to make mistakes in the financial markets.

The only shame is making the same ones over and over.

Investment losses can be money well “spent” if you understand what you did wrong and why.

Perhaps Tyson’s greatest investment wisdom was this little pearl: “Everyone has a plan until they get punched in the mouth.”

How true! Many investors put money at risk only when they feel optimistic about the economy, the stock market and the future in general.

Big mistake.

Things go well for a while but then the unexpected happens… Interest rates spike up. The economy turns down. A hedge fund blows up. A new hot war ignites in the Middle East. Or the stock market experiences a sharp correction, a new bear market or an outright crash.

It’s times like these that separate the men from the boys.

That’s why you should know well in advance what you’d do in such circumstances.

Experienced investors view sudden sell-offs as opportunities.

When everything drops in value at the same time, prices get detached from values.

More to the point, they get detached from reality.

We saw this during the recent bear market.

There were so many bargains – not just in U.S. stocks but in high-yield bonds, foreign equities and real estate investment trusts – yet it’s surprising how many people I talk to who sat on their hands and did nothing.

Why? Because they never considered how they would feel to find themselves on the ropes, chastened and exhausted.

So take Mike Tyson’s “advice.”

Invest from a defensive position. Learn from your mistakes. And know in advance what you’ll do if the market gives you a punch in the mouth.

If it bites off part of your ear, on the other hand, you’re on your own.