“What’s nice about investing is you don’t have to swing at pitches. You can watch pitches come in one inch above or one inch below your navel, and you don’t have to swing. No umpire is going to call you out. You can wait for the pitch you want.”

– Warren Buffett

2018 has been a tough year for Warren Buffett.

Berkshire Hathaway Class B (NYSE: BRK-B) hit a record high of $217.62 on January 29.

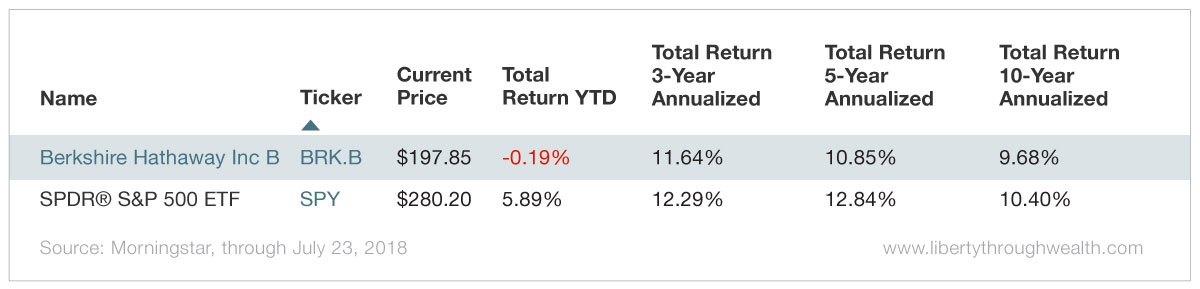

Since then, it’s traded mostly below $200 – about 10% off its high and substantially lagging the S&P 500.

Yes, I know that Buffett invests for the long term. And, yes, I know that questioning Buffett’s investment wisdom has been a mug’s game.

Still, even the most hardcore Buffett fans must concede that Berkshire’s performance has been lagging the S&P 500 for quite some time.

Worryingly, Berkshire is not only trailing the S&P 500 in 2018…

As it turns out, it’s trailed the S&P 500 over the past three, five and 10 years as well.

Luckily for shareholders, Buffett has adopted a new financial policy to boost Berkshire’s lagging returns, possibly making it an ideal time to invest in the underperforming stock.

Let me explain…

Buffett’s Love Affair With Cash

Buffett has long been committed to keeping $20 billion in cash on Berkshire’s balance sheet.

He has used it as a hedge against a black swan event – say, another Hurricane Katrina – that could hammer Berkshire’s insurance business with enormous and unexpected losses.

Today, that cash level has swelled to over $109 billion – more than five times Buffett’s commitment.

And that’s after Berkshire’s purchase over the past two years of 250 million shares of Apple, which today are worth about $47.5 billion.

Throw in the windfall from the Trump tax cuts (Barclays estimates it at about $37 billion) and Berkshire was left with even more cash.

Buffett could spend $89 billion and still maintain the $20 billion cash stash on Berkshire’s books.

Put simply, Buffett can’t invest Berkshire’s cash fast enough.

Berkshire’s High-Quality Problem

Buffett has always been on the hunt for game-changing deals to put Berkshire’s cash pile to work.

But at Berkshire’s current size, it’s hard to find a deal large enough to make any difference.

To put it in perspective, Berkshire’s cash hoard would be enough to buy Colgate-Palmolive Company (NYSE: CL) almost twice over.

Also, at this stage of the market cycle, too much money is chasing too few deals. After a nine-year bull run, Buffett is a Walmart shopper in a Tiffany’s world.

To use Buffett’s metaphor, he’s seeing a lot of pitches…

He’s just not swinging.

How to Spend All That Cash

My own view is that Buffett has been keeping his cash powder dry to exploit opportunities he expects to see during the next inevitable bear market.

By acting as a lender of last resort, Buffett could hoover up all sorts up sweetheart deals, as he did in 2008.

In the absence of any big deals, how else can Buffett spend his money?

First, Buffett could pay a dividend – something he has never done.

Second, Buffett could allocate more money to his portfolio managers, Todd Combs and Ted Weschler. That would accelerate Berkshire’s transformation into a mutual fund-style investment focusing on publicly traded companies.

And…

Buffett’s New, New Strategy

On July 18, Berkshire added another arrow to its quiver of cash-spending strategies: buying back its own stock.

On that day, the company’s board of directors amended Berkshire’s share repurchase program.

The previous program allowed Berkshire to buy back shares when its price-to-book (P/B) value was below 1.2, meaning it was selling for less than a 20% premium.

But starting August 3, Berkshire will have the right to repurchase shares any time both Buffett and Charlie Munger believe the repurchase price is below Berkshire’s conservatively determined intrinsic value.

The fuzzy formulation of “conservatively determined” gives Buffett and Munger considerably more leeway than the previous P/B target price did.

Investors loved the idea. The next day, Berkshire’s share price soared more than 5% on the news.

It was Berkshire’s best day in seven years.

By increasing his willingness to buy back Berkshire stock, Buffett has refocused his efforts on putting this excess cash to work.

With the average price target on Berkshire Hathaway Class B at $227.50 per share, there is now a substantial 15% upside to the stock.

And the price targets don’t yet include the effects of Berkshire’s new share buybacks.

My recommendation?

After a decade-long stint of underperformance, take another swing at Berkshire Hathaway.

You’ll be glad you did.

Good investing,

Nicholas