“I’m getting pretty skeptical about all these ETFs I’m reading about. Isn’t it getting to the point where any two guys and a dog can launch an ETF?”

This was the very first question – posed by a well-dressed gentleman – following my ETF (exchange-traded fund) presentation last week on the 30th Annual Forbes Cruise for Investors on the Danube to and from Vienna, Austria.

It was a hard-hitting but fair question.

And here is my answer…

Yes, the explosion in the number of ETFs over the past few years has attracted many small-time players looking to make a quick buck.

(You saw the same thing with dot-coms in the 1990s and hedge funds in the early 2000s.)

But I also reminded him that ETFs represent the single most investor-friendly development in the history of investing.

Let me explain…

When I was a mutual fund manager in the 1990s, investors paid a 4.75% front-end load just to invest in my fund.

(The load was a kickback to the slick-talking brokers who directed their clients into the fund.)

And they paid this even before the 1.5% annual management fee the fund charged once investors got in.

Fast-forward 20 years, and the investment landscape has changed beyond recognition.

Today, some of the biggest names in investing – BlackRock, Vanguard, Fidelity, Schwab, Goldman Sachs and J.P. Morgan – are all clamoring to invest your money in ETFs… and manage it (almost) for free.

These developments are saving investors literally billions of dollars a year.

ETFs have another significant advantage beyond low fees. The ETF revolution has unleashed remarkable creativity among both financial engineers and marketers.

ETFs today allow you to invest in almost any asset class and any strategy…

U.S. and foreign stocks, fixed income across the globe, international currencies and commodities… You name it.

You can even bet on future stock market volatility.

But, in life, your greatest strength can turn out to be your greatest weakness.

The same applies to ETFs.

In the early days, ETFs just tracked mainstream indexes like the S&P 500 or the MSCI Emerging Markets Index.

Then, a handful of smart beta ETFs began to exploit long-standing market anomalies.

My favorite example?

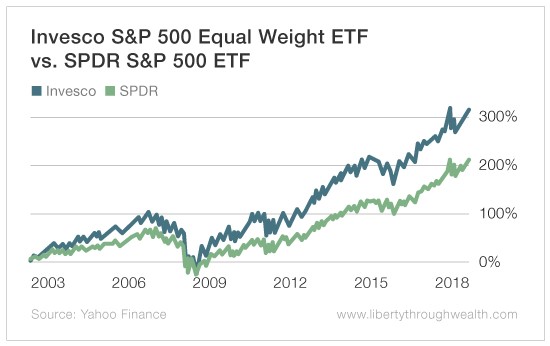

The Invesco S&P 500 Equal Weight ETF (NYSE: RSP), which has beaten its market cap-weighted counterpart by about 2% per year for 19 years.

Same stocks. Different weighting. Yet this small difference adds up to a massive increase in performance over time.

Other historically robust market anomalies – based on momentum, quality or investments in Dividend Aristocrats – have also stood the test of time.

At the same time, the explosion of ETFs has also resulted in the launch of fad-driven ETFs with no investment edge.

The past two years have seen the launch of ETFs for Republicans, Democrats, Trump supporters, LGBTQ rights activists, and women’s empowerment advocates.

Will investing in a “Republican” company (whatever that means) make you more money than investing in a “Democrat” one?

Whatever your answer, it’s not a strategy that has been rigorously tested.

The good news?

Most faddish ETFs live a short life.

Both the Republican and Democrat ETFs have closed for lack of investor interest.

The bad news?

The problem of faddish ETFs is about to get worse.

The SEC recently voted unanimously to propose the “ETF Rule.” This would reduce filing costs for establishing ETFs to about $25K. Ten years ago, that cost was $1 million.

Assuming the rule is adopted, expect to see many more niche ETFs soon.

So, yes, two men and a dog can launch an ETF nowadays.

But don’t throw that baby out with the bathwater.

Instead, stick with the robust investment strategies offered by well-established ETF providers.

And let me act as your guide through the ever-deepening ETF jungle with my upcoming ETF service.

Good investing,

Nicholas