If you’re an investor who hopes the economy stays strong and stocks keep rising, I have good news.

The world’s worst economic forecaster just turned bearish.

Yes, I know, I’ve warned for years that no one can accurately and consistently forecast the economy or time the market.

Perversely, however, there are a few individuals whose views are so blinkered – and whose pronouncements so ill-advised – they have become nearly perfect contrarian indicators.

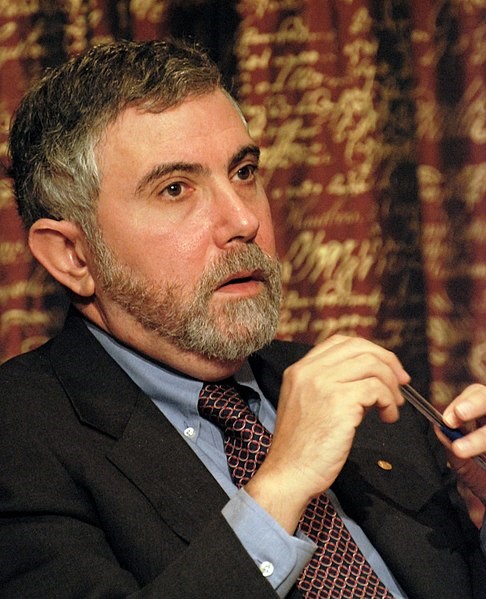

Economist and New York Times columnist Paul Krugman is one of them.

Disbelieving his predictions – and acting counter to his advice – has proven to be a winning strategy, not just for years but for decades now.

As contrarian signals go, the “Krugman Indicator” is one of the best. And right now it is ringing like a fire alarm.

On January 3, after citing a handful of widely followed leading indicators – including the faltering stock market – he proclaimed on Twitter “that the Trump boom, such as it was, is over.”

Investors reacted immediately by driving the Dow up 800 points in the very next session… and another 500 in the three that followed.

Krugman alone wasn’t responsible, of course. We also got a blockbuster jobs report and news that wages had taken a historic jump.

But that’s just it. The economic data began to contradict his view less than 24 hours later.

This is no anomaly.

Krugman has a long history of making pronouncements that are gloriously, spectacularly wrong. Consider:

- He predicted in Time magazine’s 100th anniversary edition in 1998 that “The growth of the Internet will slow drastically… By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.”

- In 2002 he suggested that then-Fed Chairman Alan Greenspan should “create a housing bubble to replace the Nasdaq bubble.” (He did – and it led to the greatest economic collapse since the Great Depression.)

- He argued before Argentina’s recent default that the country’s economy was a “remarkable success story.”

- He called the U.S. “just a bystander” in global energy only months before hydraulic fracturing and horizontal drilling started to make us the biggest oil and gas producer in the world.

- When our sovereign debt roughly doubled during the Obama administration, he complained bitterly that the federal government wasn’t spending nearly enough. (He even wrote a book about it – End This Depression Now! – arguing for “a burst of government spending to jump-start the economy.”) Japan tried this recipe and wound up with near-zero growth and the world’s largest debt-to-GDP ratio.

- He predicted a financial collapse if Donald Trump won the presidency, then posted this on election night 2016: “It really does now look like President Donald J. Trump, and markets are plunging. When might we expect them to recover? A first-pass answer is never… We are very probably looking at a global recession, with no end in sight.”

Instead we have had the best economy in decades, near-record-low unemployment, rising wages, booming capital spending, record corporate earnings and U.S. household net worth at an all-time high.

Thank you, Paul Krugman. Thank you.

Making economic prognostications is a treacherous business under the best of circumstances, of course.

The world is a messy, complicated place.

The global economy is affected by politics, legislation, war, inflation, interest rates, energy prices, currency fluctuations, market movements, consumer confidence, scientific advances and technological innovation, to name just a few.

That can make economic forecasters about as credible as Miss Cleo on The Psychic Friends Network.

Surely, Krugman knows that economics is an inexact social science and that predicting a $20.4 trillion national economy – let alone a $77.6 trillion global economy – is a mug’s game, one that shouldn’t be taken too seriously.

Yet Krugman is nothing if not serious.

His columns brim with disdain for those who might disagree with him.

In his blog, he regularly refers to his intellectual adversaries – many of whom hold honors and degrees as great or greater than his own – as “mendacious idiots,” “knaves,” “poseurs,” “whiners,” “trolls,” “dopes,” “fools” or “cockroaches.”

Krugman isn’t just mistaken. He’s also a bit of a jerk.

(I once had one of the most unpleasant lunches of my life with him. He bellyached so long about so much I could have sworn I heard him say the sky was too blue and the birds were singing too loud.)

Every serious investor knows that economic growth, interest rates, inflation and the stock market itself cannot be consistently and accurately forecasted.

Yet Krugman puts his economic theories and policy advice forward without even feigning humility.

Pulitzer Prize-winning columnist George Will – who sparred regularly with Krugman on ABC’s This Week – once noted, “If certainty were oil, Paul would be Saudi Arabia.”

What is Krugman certain about now? That the Trump boom – “such as it was” – is over.

As contrarian indicators go, this is one of the best. Stay long.

Good investing,

Alex