On January 1, The New York Times included a special foldout section called “The Year in Pictures 2022.”

There were photos of bombed-out cities and towns in Ukraine – along with the corpses of Russian soldiers, Ukrainian fighters and civilians.

There was a photo of a village in Indonesia that was devastated by a 5.6-magnitude earthquake.

There was a photo of a child working at a coal mine in Afghanistan.

There was a photo of houses in North Carolina that collapsed into the ocean due to beach erosion and rising sea levels.

There was a photo of a skirmish between Israeli police officers and mourners carrying the coffin of a slain Palestinian.

There was a photo of a woman mourning her grandmother’s death in a mass shooting.

There was a photo of an alley in the Itaewon district of Seoul, where a crowd surge at a Halloween celebration killed more than 150 young people.

There was a photo of a marina in Fort Myers, Florida, destroyed by Hurricane Ian.

It was enough to make me wince every time I turned the page.

The exposé wasn’t entirely negative, of course. There were a few shots of people smiling or celebrating.

But readers got the gist. Despite the occasional ray of light, life in this world is one long veil of tears.

While millions of people suffer each year, the media’s relentless pessimism – plus the average American’s dystopian gloom – is not the whole story.

As Max Roser, founder of the superb website Our World in Data, likes to point out, it is possible for all three of the following statements to be true…

- The world is much better.

- The world is awful.

- The world can be much better.

While we have no shortage of problems and setbacks, most of the important benchmarks – human longevity, child mortality, living standards, etc. – have improved dramatically over the years.

And our quality of life can – and almost certainly will – be better still in the future.

That’s why I’m bullish on the outlook for the economy and U.S. stocks.

In Monday’s column, I focused primarily on the irrational fear many have that we’re experiencing the kind of entrenched inflation that we battled in the late ’70s and early ’80s.

It’s not happening. The inflation of the last two years was due primarily to business lockdowns, multitrillion-dollar government deficits and interest rates near zero.

Those are all behind us now.

And so are plenty of other things that plagued the economy and the stock market recently.

Let’s start with the great upsetter: COVID-19. The virus is still with us but the pandemic is waning.

The overwhelming majority of people are working, traveling, playing and entertaining without masks or social distancing.

And consider energy.

Oil prices surged 50% during the early part of last year. But they are back down where they were a year ago.

Natural gas prices in Europe and the United States have tumbled to levels not seen since Russia invaded Ukraine.

And speaking of Ukraine… Despite a minor advance by the Wagner Group this week, Russia is losing that war.

Vladimir Putin has gutted the military, crippled his economy, tanked the ruble, damaged his partnership with China, alienated trading partners and caused a stampede of draft-eligible men out of the country.

Rather than weakening NATO, he made the alliance bigger and stronger than ever.

His army is on its heels. His air force can’t fly over the country. And his navy is afraid to approach the shore.

Yes, he’s getting help from Iran in the form of drones. But the United States is already putting sanctions on the drone manufacturers.

Meanwhile, the Iranian people are demonstrating in the streets, clamoring for the rights we take for granted in the West.

Consumer prices were high last year. But the annual inflation rate in the U.S. slowed for a sixth straight month to 6.5% in December, the lowest level since October of 2021.

Inflation averaged just under 2.5% in the second half of 2022, only slightly above the Fed target of 2%.

The wage gains of about 6% did not for most of the year keep pace with inflation.

But as inflation moderates, those gains will stay, providing lasting improvement for workers.

There were other positive developments in 2022.

Poverty continued its multiyear decline. (There has been a 59% drop in child poverty in the U.S. since 1993.)

Analysts talk about the end of globalization and how it will limit choice and raise prices.

But global trade is headed for a new high of $32 trillion this year.

(That’s partly because Asian nations are strengthening bonds with each other and becoming less dependent on Communist China.)

California’s Lawrence Livermore National Laboratory achieved the first viable fusion reaction, which may eventually translate into the ultimate clean energy.

OpenAI, a consortium of artificial intelligence (AI) research companies, released ChatGPT, a sophisticated AI language program that can simulate human prose.

AI will ultimately help us unlock new energy sources, mitigate the effects of disease and increase productivity.

It’s not possible, of course, to take a photo of falling inflation or declining poverty or rising living standards.

But that doesn’t mean the progress that journalists don’t report isn’t happening.

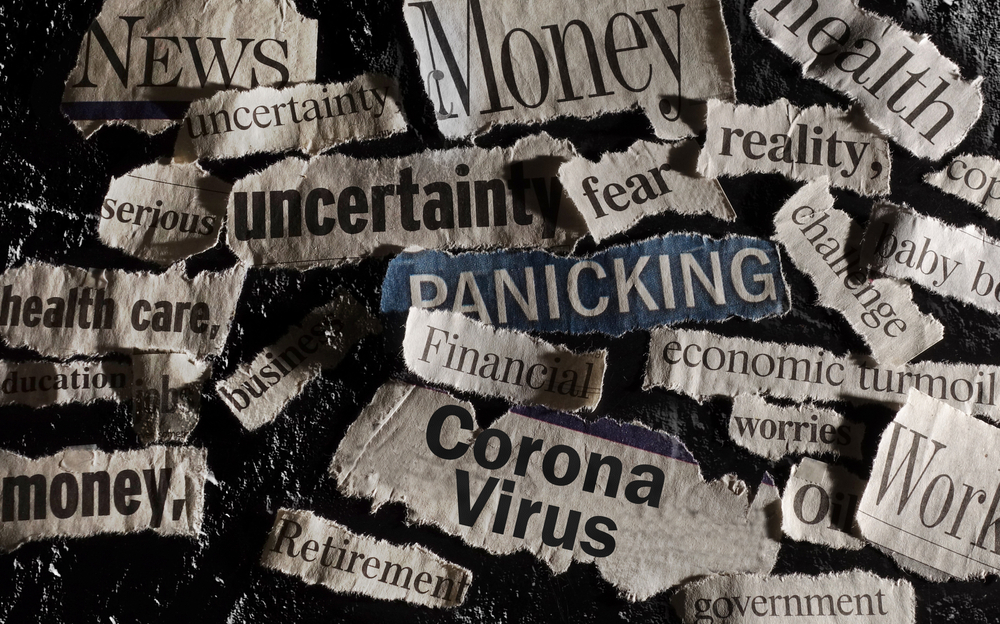

If you listen only to the drumbeat of negativity from the media – or the perennial doomsaying from the merchants of gloom in the investment newsletter industry – you get a worldview distorted by anger, outrage and fear.

The reality? People in the West today are living longer, healthier, safer, richer, freer lives than ever before.

If you don’t recognize it, you can’t take advantage of it as an investor.