The best investors are always educating themselves.

They often familiarize themselves with the great men and women – often unknown – who shaped the modern investment landscape.

Why should you care about these individuals, especially since many of them are long dead?

Because Sir Francis Bacon was right: Knowledge is power.

This is especially true in the financial markets. And the type of knowledge you accumulate is the primary determinant of your success as an investor.

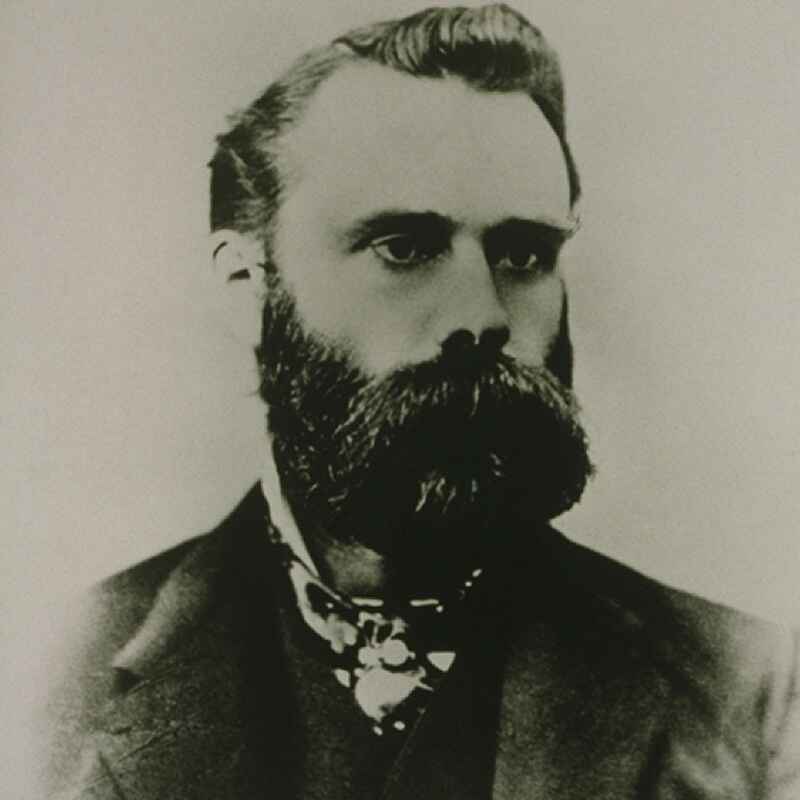

Consider a man whose name is legendary on Wall Street: Charles Dow.

Dow is a significant figure in the annals of financial history for two reasons…

He created the first financial bible, The Wall Street Journal (WSJ), and the first market barometer, the Dow Jones Industrial Average.

In doing so, he revolutionized the way we talk about financial markets.

(By the way, Charles Dow is sometimes credited with creating Dow Theory, too. Not true. The market-timing strategy was extracted from his WSJ editorials 20 years after his death by a market technician named William P. Hamilton.)

Charles Dow founded Dow, Jones & Company with a partner in New York in 1882.

At the time, most financial data was simply outdated news and unreliable gossip.

But the Dow Jones company published daily financial updates in a two-page newspaper called the Customer’s Afternoon Letter – the Wall Street Journal’s predecessor.

It was in the Letter that Dow first published his average, initially comprised of 14 companies – 12 railroads and two industrials.

Today the Dow consists of 30 large companies meant to reflect the U.S. economy. (There are, however, few holdings in heavy industry – and no railroads.)

The average, price-weighted to compensate for stock splits and other adjustments, is the most closely watched benchmark for tracking stock market activity.

Yet the Dow is actually a poor representation of the broad market.

If you’re looking to capture its performance, you are much better off owning the better diversified S&P 500 (NYSE: SPY) or the Wilshire 5000 (NYSE: TMW).

The important thing to learn from Charles Dow is the primacy of financial information.

More than a hundred years ago, he realized that it was essential for investors to have not just opinions, rumors and forecasts but verifiable facts.

Those are not always easy to obtain today with the ascendancy of blogs and especially social media, which puts every idiot in touch with every other idiot.

To beat the market, investors simply must be well informed and up – to date beyond this week’s headlines.

I’ve known folks who will buy a stock and then not keep abreast of the direction of sales, the growth in profits or even how the company is performing relative to its competitors.

This is an act of faith not rational investing.

Charles Dow created a daily business publication to give investors the essential facts they need.

Of course, today we all get our information in real time off the internet.

But the important data is not today’s government statistics or some new pronouncement by Jerome Powell. This is mere trivia in the longer term.

Real value is found in the hard numbers that tell us how individual businesses are performing.

That means the kind of investment news you consume is crucial.

Listen to economic analysts, for example, and you’ll hear gloom and doom about sticky inflation, rising wages, and the likelihood – or unlikelihood – of a Fed rate cut.

Listen to market analysts and you’ll hear trivia about short-term trends, changes in volume, support and resistance levels, and so on.

This is not the type of information that will not make you rich.

However, if you listen to business leaders, you’ll learn plenty about scientific innovations, increases in productivity, new technologies, market share, and – not least of all – corporate sales and earnings.

In short, investors who listen to corporate presidents and CEOs do a lot better than those who follow economic forecasters and market timers.

Charles Dow knew this. You should, too.