Last Friday, my friend John Mackey – founder and former CEO of Whole Foods – and I debated Chris Hunter and Joel Bomgar at FreedomFest in Las Vegas, a libertarian conference with more than 2,000 attendees.

The debate topic? “When Will This Bitcoin Bubble Ever Crash?”

Our opponents don’t believe the world’s leading crypto is a bubble. They see much higher prices.

Of course, they’re talking about their book.

Hunter has created four Bitcoin companies: Galoy, Blink, Epoch VC, and Satoshi.

Bomgar is President of Prospera, a private city on the island of Roatan that has adopted Bitcoin as legal tender.

John led off the debate, pointing out that Bitcoin is a non-productive asset with no present or future cash flows, that it solves no real-world problems, and creates no value.

I picked up on the bubble theme, pointing out that Bitcoin is up 58,000-fold over the last 14 years. Even though it is far too volatile for most transactions, used by few consumers, and more than 99.9% of retailers and websites won’t accept it.

In fact, many who once did have thrown in the towel, discovering that – however good it sounded in theory – it didn’t work in practice.

Bitcoin, for example, was supposed to make transactions faster. It makes them slower.

(The typical transaction takes between 30 minutes and two hours.)

It was supposed to make them cheaper. Instead, fees make them more expensive.

It was supposed to make transactions easier. Instead, it makes them more difficult.

And it has a big scalability problem. Bitcoin cannot process more than seven transactions per second. That’s a hard limit.

Visa, by comparison, can process tens of thousands of transactions per second.

Our arguments went unrefuted by our opponents.

Instead, they pointed out that Bitcoin operates on a decentralized network, uncontrolled by any government or central bank.

They noted that Bitcoin transactions are cryptographically secured, protecting integrity and making them secure.

And they emphasized that – unlike fiat currency – Bitcoin has a maximum supply of 21 million coins.

What they couldn’t do was explain how – aside from speculation – Bitcoin could make anyone’s life simpler, easier, or better.

Instead – like penny stock promoters – they made a lot of big claims about “the future.”

They offered no way to determine whether the market price of Bitcoin is undervalued or overvalued.

And they could not explain why – even though Bitcoin is now over 14 years old (an eternity in the tech world) – it has not been widely adopted.

Instead, they emphasized that Bitcoin would go up a lot more.

It’s clear that it has had a spectacular run over the last several years. Yet the bloom is already off the rose.

Bitcoin currently trades around $64,000. Just like it did in November 2021.

If I recommended a tech stock at $64 three years ago – and it was still trading at that level nearly three years later – I don’t think I’d be excited about what a red-hot investment it is.

The next big move in Bitcoin is likely to be down… not up.

After all, we’ve just about run out of extraneous factors like the recent halving event – known years in advance – and the SEC’s reluctant adoption of Bitcoin ETFs.

Of course, you cannot make a rational projection about when irrational behavior will end.

So, it’s possible that Bitcoin could rise from the ashes and rally again.

Yet that will only delay the eventual implosion.

This is the greatest speculative bubble of the modern era, one that economic historians will be writing about for decades to come.

Bitcoin is an index of illicit activity. It has no credible uses. It has no valuation criteria. It is volatile, slow, costly, energy inefficient, and the industry is rife with deceit, fraud, and abuse.

Indeed, it may be regulators who put the final nail in Bitcoin’s coffin.

Why hasn’t that already happened? Money and politics.

Convicted fraudster Sam Bankman-Fried – founder of defunct crypto exchange FTX – gave roughly $40 million to Democrats.

His partner Ryan Salame gave $23 million to Republicans.

Sound familiar?

When then-candidate Donald Trump was campaigning for President in 2016, he was asked why he donated generously to both Republicans and Democrats.

“Because I’m smart,” he replied.

No further explanation was needed. If you want Washington, D.C. to do your bidding, the best strategy is to grease palms on both sides of the aisle.

However, Bitcoin has been a godsend for drug cartels, terrorist networks, human traffickers, heavy weapons dealers, blackmailers, extortionists, money launderers, tax cheats, and nations looking to evade economic sanctions.

You must be blind – or a true believer – not to see a regulatory crackdown coming.

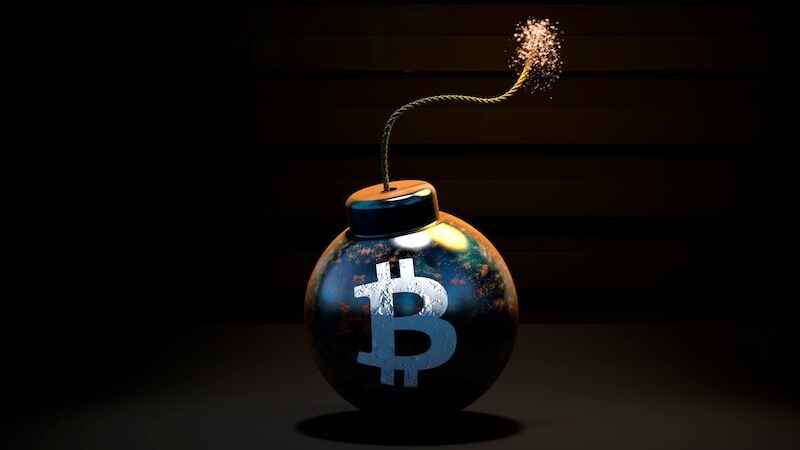

The clock is ticking. Just like Bitcoin itself.

Those who fear missing out on any further upside might want to strap themselves into one of those bomb disposal outfits like Jeremy Renner wore in The Hurt Locker.

One day – and it might be soon – they’re going to need it.