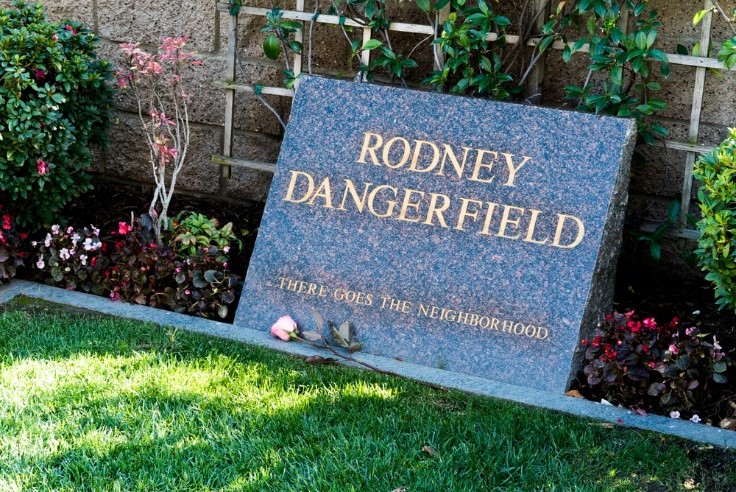

“Market sentiment” is the Rodney Dangerfield of investing. (Among most professional investors, it “gets no respect.”)

And that’s no surprise. After all…

“Fundamental analysis” parses real-life balance sheets and income statements.

“Technical analysis” tracks complex indicators like oscillators, stochastics and Bollinger Bands.

“Modern finance” applies college-level mathematics to tease out investment insights.

Investing based on “market sentiment” seems simplistic in comparison.

Here’s the irony…

The world’s best investors don’t just use market sentiment to make investment decisions…

They believe it’s the most important factor behind their success.

Buffett’s Secret Weapon

Warren Buffett is a disciple of value investing legend Benjamin Graham.

That puts Buffett firmly in the camp of fundamental analysis.

But when asked what the single most crucial lesson Graham taught him was, Buffett cited Graham’s discussion of “Mr. Market.”

In The Intelligent Investor, Graham compared the market to a manic-depressive.

Some days, Mr. Market is euphoric. Other days, he’s very depressed. If you catch him on a euphoric day, he wants a very high price for his shares. If he’s in one of his down moods, he’s willing to sell you his shares for a pittance.

Mr. Market highlights the only thing you can predict about financial markets…

That investors will always overreact to events, whether positive or negative.

Why Market Sentiment Matters

So why is market sentiment the key to so many top investors’ success?

The answer is simple: It works.

And every other approach to investing has become commonplace.

When Graham and David Dodd published Security Analysis in 1934, they were pioneers of value investing.

But value investing has become the victim of its own success. Today, every financial analyst from New York to Nairobi values companies the same way.

You can say the same about Robert Edwards’ and John Magee’s classic Technical Analysis of Stock Trends (1948).

Thirty years ago, technical analysts drew charts and calculated technical indicators by hand. Today, thousands of these indicators are a mouse click away.

And what about “modern finance” as taught in business schools?

As I’ve written before, most of it is bunk.

But what do all markets have in common, no matter what lens you view them through?

They have always been driven by investor sentiment.

No new whizz-bang theory of investing can change that.

Profiting From Mr. Market’s Mood Swings

So how can you use market sentiment in your own investing?

It turns out that market sentiment is surprisingly quantifiable.

One of my favorite websites, SentimenTrader.com, generates a handful of customized sentiment indicators every day.

But if you are looking for a “quick and dirty” solution…

I recommend CNN’s “Fear & Greed” Index. (I have it bookmarked on my computer, and I look at it every day.)

The Fear & Greed Index tracks seven market sentiment indicators.

Of course, you can quibble about the accuracy of each. But taken together, they give you reliable insight into Mr. Market’s current mood.

So where does the market stand during these dog days of summer?

Trade wars with China, Russian sanctions and Trump hate may dominate the financial headlines…

Yet Mr. Market is feeling surprisingly good about the world. The irony?

Positive market sentiment does not make it a good time to invest. That’s because market sentiment is a contrarian indicator.

The best opportunities to invest are when Mr. Market is down in the dumps.

And that is not the case today.

Let me share my personal rule of thumb…

I will increase my bets in the market when the Fear & Greed Index drops below 20. (The last time this happened was after the January market sell-off.)

Investing in the stock market during those times is tough – it often feels just plain wrong.

Still, here’s what hard-won experience has taught me…

By betting against Mr. Market’s mood swings, I’m doing the right (and profitable) thing.

I strongly recommend you do the same.

Good investing,

Nicholas