- It has been many years since gold has seen the spotlight. Investors can still get in on the profits even if it’s not there to stay.

- Today, Mark Skousen explains how an ETF for gold can pay off for investors.

Gold and silver are back!

It’s been a long time since gold and mining stocks were in the limelight. Precious metals slogged through eight losing years (2011-2019) before finally catching fire again.

Most mining stocks fell 60% to 70% before recovering. The penny stocks lost even more. It was a treacherous bear market that hurt a lot of investors who bought into the doom-and-gloom predictions.

Fortunately, I recommended selling gold and silver in late 2011, and investing 100% in the stock market – one of my better calls in Forecasts & Strategies. (To learn about my favorite stock that’s already up 34% this year and has outperformed the market and Warren Buffett since 2012, click here.)

The Agony of Defeat… and the Thrill of Victory!

“You’ve endured the pain, why not enjoy the gain?”

– Rick Rule

I well remember speaking at the New Orleans Investment Conference, an annual gathering of gold bugs, back in 2016. After giving a talk debunking the pessimistic Cassandras at the conference, I was surrounded by several attendees. They said, “We’ve lost 70% of our portfolio.”

I responded in dismay, “How is that possible? The stock market is at an all-time high.”

They said, “We bought into the doomsday scenario, sold our stocks and bought the mining companies exhibiting at the conference. Our portfolio is now down 70%.”

I was dumbfounded by this double whammy and the danger of investing too much in one sector, especially one as notoriously volatile as mining stocks.

I asked, “So what are you doing here?”

“We’re doubling down!”

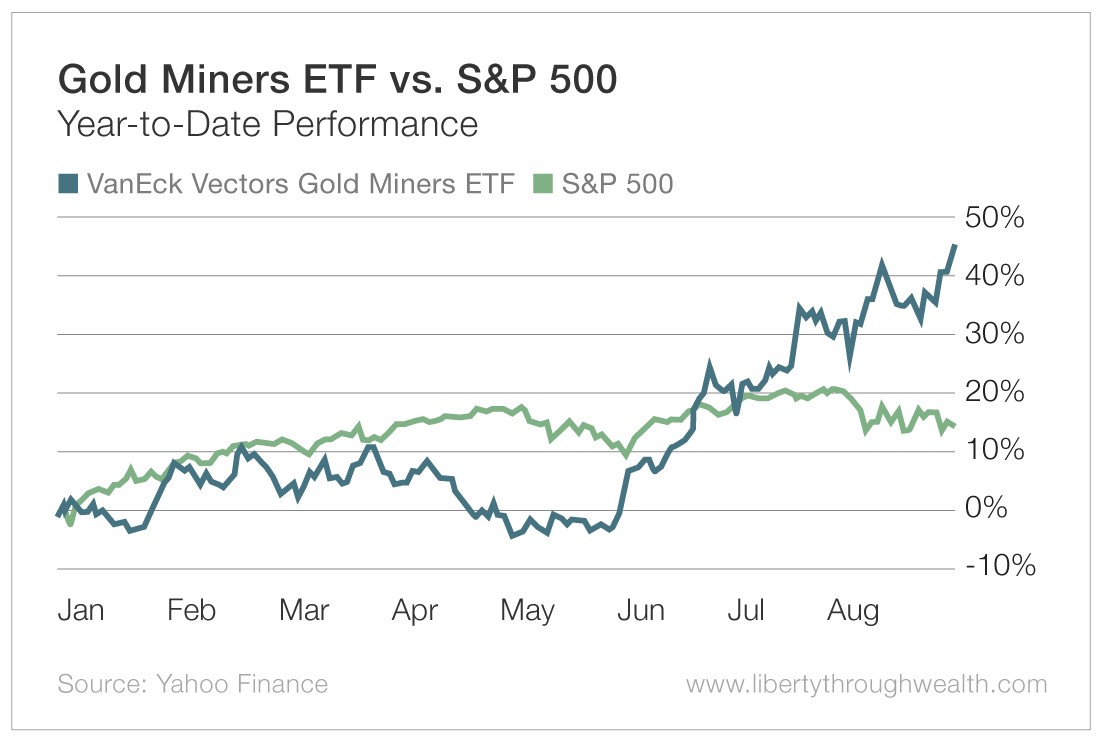

Now, finally, in 2019, their long-suffering patience has paid off, and they are enjoying the new bull market in gold. Many mining stocks have doubled or tripled this year.The VanEck Vectors Gold Miners ETF (NYSE: GDX) is up more than 40% in 2019.

I even made the plunge, recommending a mining finance company in December. We’re up 39% on it so far.

A New Day for Gold and Silver

What caused gold and silver to come out of hibernation?

First, interest rates have declined to all-time lows and rates are even negative in Europe. The Fed decided to stop raising interest rates in 2019 and recently reversed its policy by cutting rates a quarter point.

The broad-based money supply (M3) is now growing at 9%, suggesting easy money is back. Since gold and mining stocks pay very little interest, gold looks more attractive.

Second, the Trump trade war has destabilized the global economy and created an economic crisis. Gold thrives on uncertainty and instability.

Third, gold and silver look cheap compared with stocks and real estate, which have climbed to near-record levels.

More to Come?

“Buy gold at any level.”

– Mark Mobius

Recently Mark Mobius, the former longtime manager of the Templeton Emerging Markets Fund (NYSE: EMF), said that gold is clearly in a bull market that could last for years.

Mark (left) pictured with Mobius, holding a copy of Mark’s book Maxims of Wall Street at the MoneyShow Orlando earlier this year.

Mark (left) pictured with Mobius, holding a copy of Mark’s book Maxims of Wall Street at the MoneyShow Orlando earlier this year.

Last week he urged investors to buy gold at any level. He added, “Gold’s long-term prospect is up, up and up.” Mobius notes that the money supply is “up, up and up.”

Indeed, with the Fed cutting rates and M3 rising 9.3% lately, “There’s going to be a demand for real assets, and that includes gold,” says Mobius.

Admittedly, the easy money has been made, but there’s still more profit ahead.

Just don’t go overboard. Invest up to 10% of your portfolio in gold and mining stocks.

And this year may be the right time to go to the New Orleans gold conference. I’ll be there, along with the usual suspects like Doug Casey, Adrian Day, Brien Lundin and other gold bugs.

Good investing, AEIOU,

Mark

P.S. Mobius is a big fan of my book The Maxims of Wall Street. It is the one and only compendium of financial adages, ancient proverbs and worldly wisdom – and it has sold more than 25,000 copies. It’s Warren Buffett’s favorite quote book, and Alex Green calls it a “classic.” Commodity guru Dennis Gartman says, “It’s amazing the depth of wisdom one can find in just one or two lines from your book.”

The book has individual sections on gold and gold bugs, growth vs. income stocks, and contrary investing, and features more than 800 adages, proverbs, stories of famous financial gurus, and worldly wisdom. It’s the perfect gift for investors, clients, money managers and stockbrokers. For special pricing, call Harold at Ensign Publishing at 866.254.2057, or go to skousenbooks.com.

Mark Skousen is a true believer in reason, self-determination, hard work and liberty. Since 1980, Mark has been the editor-in-chief of the award-winning investment newsletter Forecasts & Strategies. He’s a successful author and publisher of several books, including The Maxims of Wall Street and Investing in One Lesson. He is also the founder of FreedomFest, an annual gathering in Las Vegas of the freedom movement from around the world.