- Disruptive technologies and story stocks are very seductive for investors because they promise dramatic results.

- But, as Nicholas Vardy explains, investing in these companies is not the best way to grow your wealth.

“You never know who’s been swimming naked until the tide goes out.”

– Warren Buffett

Harvard Business School professor Clayton Christensen passed away last month.

A rock star among business school academics, Christensen coined the phrase “disruptive innovation” in the mid-1990s.

The phrase refers to when a smaller company with fewer resources shakes up an industry. By delivering a groundbreaking product or service, it causes incumbent giants to stumble.

Examples of today’s disruptive innovations include cloud-based software, electric vehicles and blockchain.

For investors, disruptive technologies are always seductive.

After all, they combine novelty, a compelling story and the prospect of endless riches.

Yet you should be cautious before betting big on any disruptive technology.

Yes, if you get it right, you’ll make a fortune. But get it wrong… and you’ll likely lose your shirt.

Disruption: Nothing New

Business school academics specialize in branding.

The term disruptive innovation is no different.

As David Landes in Harvard’s history department could have told Christensen, the idea of disruptive innovation is hardly new.

After all, technological change has driven economic history since the Industrial Revolution.

Just consider the history of the United States.

Railroads in the 1860s, automobiles in the 1910s and airplanes in the 1920s all disrupted transportation.

The telegraph in the 1840s, radio in the 1920s and television in the 1930s all disrupted communications.

Natural gas in the 1820s, oil in the 1860s and electricity in the 1880s all disrupted energy.

These disruptive technologies transformed the daily lives of tens of millions of Americans. Today’s disruptors continue a long-established historical pattern.

Investing in Disruption

Successful disruptive technologies produced generational fortunes. That’s why we still recognize the names Carnegie, Rockefeller, Ford and Edison today.

We don’t see the fortunes lost by investors who bet on the wrong companies, the wrong technologies or the wrong entrepreneurs.

That’s why investing in disruptive technologies presents unique challenges.

First, disruptive technologies upend the rules of the investing game.

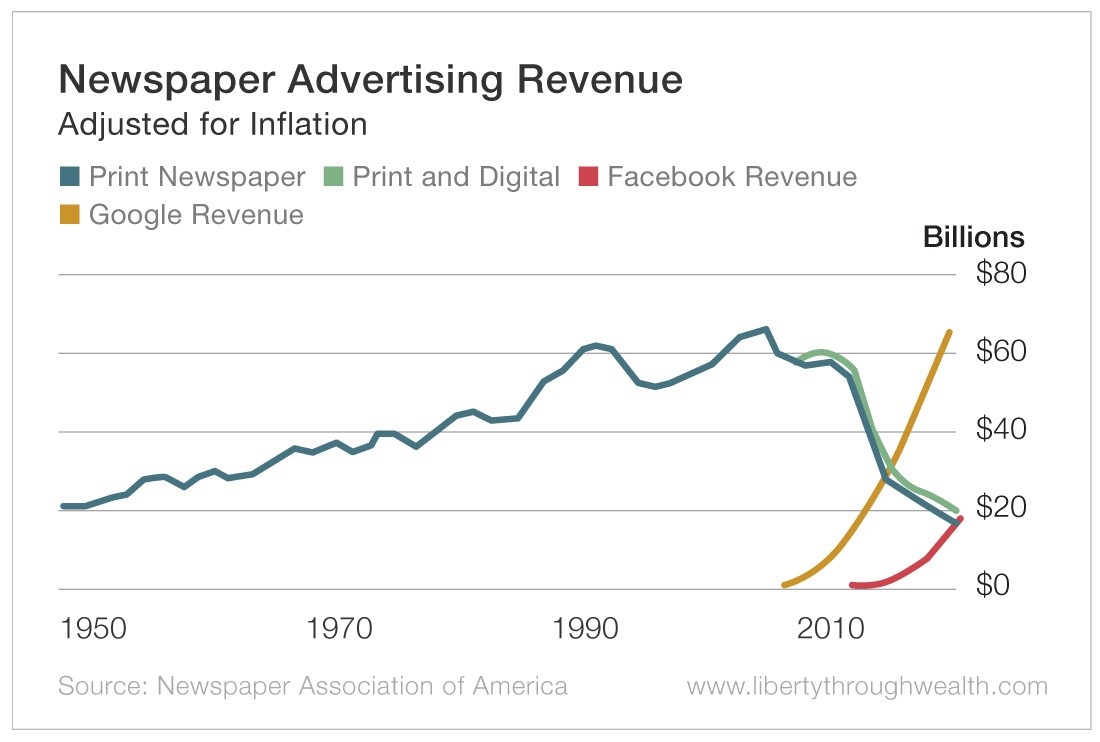

Just consider the fate of one of Warren Buffett’s favorite industries: newspapers.

For many decades, major newspapers offered a local monopoly on the advertising business. This monopoly ensured the steady, dependable growth Buffett craved.

Then two disruptors entered the fray: Google and Facebook.

The chart above confirms a recurring pattern. It can take years for a disruptive technology to take hold. But when it does, the results are dramatic.

Eventually, Buffett threw in the towel and exited the newspaper business.

And today, both Google and Facebook are worth more than Buffett’s Berkshire Hathaway.

Second, you can identify the winners only with the benefit of hindsight.

And contrary to the tenets of disruptive technology, the brash, new upstart does not always prevail.

Take the example of Microsoft and cloud computing.

With annual revenues of $125 billion, Microsoft is hardly a newbie. Yet the disruptive cloud now makes up a third of its business. And that segment is growing at nearly 40%.

In contrast, former tech giant (and Buffett investment) IBM faltered in the very same business.

When current CEO Satya Nadella took over in 2014, Microsoft was worth 70% more than IBM.

At a market cap of $1.32 trillion, Microsoft is now worth 11 times as much as its former rival.

The lesson? You don’t have to be a disruptive iconoclast to prevail.

And third, disruption is a fertile field for story stocks.

I’ve written about the dangers of investing in story stocks. “This time it’s different” is rarely a formula for making a fortune.

Just a year ago, Wall Street hailed tech company WeWork and vaping giant Juul as icons of disruptive technologies.

Fast-forward 12 months and WeWork has imploded spectacularly. Its value plummeted from a high of $47 billion to less than $5 billion today.

Tobacco giant Altria just took a $4.1 billion write-off of the value of disruptive vaping pioneer Juul. That was after a $4.5 billion write-off in October.

Is the Tide of Disruption Going Out?

Disruptive companies tend to crop up toward the end of a bull market.

But as WeWork and Juul confirm, a shift in market sentiment leads to stunning evaporation in value.

The lesson?

Not all disruptive companies are swimming naked… but most of them probably are.

When the tide of investor sentiment goes out, don’t get caught with your pants down.

Good investing,

Nicholas

P.S. Harvard historian David Landes’ 1969 classic, The Unbound Prometheus: Technological Change and Industrial Development in Western Europe from 1750 to the Present, offers a far more nuanced view of technological change than the latest buzzwords from academics at the nation’s top business schools.

Interested in hearing more from Nicholas? Follow @NickVardy on Twitter.