“What a bloody frustrating year it’s been!” chortled an acquaintance portfolio manager of mine at a recent reception for London investment bigwigs.

He manages an extensive portfolio of U.S. stocks…

And the constant ups and downs of the U.S. stock market were clearly taking their toll.

After downing his second glass of Italian Barolo under the warm English summer sun, he asked me, “2017 was so easy! But how the bloody hell can anyone make money consistently in the U.S. markets in 2018, Nick?”

“You can make money,” I replied calmly. “You just need to know where to look.”

Today I’ll reveal to you the same thing I told him…

It involves one of my favorite big-picture themes in the U.S. stock market – a theme I expect to end 2018 with the same 20% gains the S&P 500 Index delivered last year.

Why am I so confident about this?

In part, it’s because we’re already halfway there.

Let me explain.

Yes, the S&P 500 has recovered somewhat since the January sell-off.

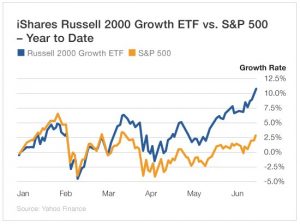

Still, it has eked out only an anemic 1.9% return year to date.

In contrast, another U.S. stock index has just broken out to new record highs.

In a mere five months, the Russell 2000 Growth Index of small cap stocks (reflected below by the iShares Russell 2000 Growth ETF) has already returned an impressive 9% this year.

Here’s why I expect it to close the year with close to 20% gains…

The “Small Cap Effect”

The small cap effect is the observation that small cap stocks consistently outperform large cap stocks over the long run.

Eugene Fama and his colleague Ken French famously put this theory to the test.

Their conclusion?

Small cap stocks did indeed generate higher returns over time than large cap stocks…

Though they did so at the cost of higher volatility.

Why small caps outperform remains unclear.

Some argue that investors have less information about small caps.

After all, Wall Street mostly sticks to covering large caps.

Others say small companies are just nimbler. They move like speedboats, while large companies trudge along like oil tankers.

Today’s big winners were all small cap stocks at one point.

Apple’s market cap was just over $1 billion when it went public in 1980; Microsoft’s stood at a lowly $780 million.

Timing the Small Cap Effect

Strong performance doesn’t make investing in small caps easy.

After all, small caps can underperform for decades, making them a difficult asset class to hold on to.

However, I’m also a big believer in taking what the market gives you.

You have to recognize when some strategies work – and when they don’t.

Today I see two major factors driving demand for higher-risk, higher-reward small caps.

First, the U.S. economy is growing faster than many of its global rivals. The Atlanta Fed estimates that Q2 economic growth in the U.S. will hit 4.1%. If growth continues at this rate, I expect small caps will rally even further.

Second, U.S. small caps have benefited disproportionately from “Trumpanomics”: lower corporate taxes, fewer regulations and protection from foreign competition.

Third, small caps get only about 20% of their revenues from overseas. That means small caps are more insulated from the geopolitical concerns and trade jitters that weigh on large caps. They also tend to thrive when the dollar is strong, which it is now.

My favorite way to profit from soaring small cap U.S. stocks is through the iShares Russell 2000 Growth ETF (NYSE: IWO).

This ETF tracks a market cap-weighted index of U.S. small cap growth stocks.

So why do I prefer the Russell 2000 Growth ETF over its rivals?

I’ve already noted how small caps tend to outperform during periods of strong economic growth.

And growth strategies tend to outperform value strategies during times like this as well.

Sure enough, value-focused, small cap ETFs lag far behind their growth-oriented counterparts this year.

Let me leave you with this takeaway…

If you invest only in small cap stocks, you will outperform the S&P 500 over the long term.

The downside of this “one size fits all” strategy is that there are long stretches of time when small caps underperform.

But in bullish years, small cap stocks can shoot the lights out.

The combination of strong economic growth with tax and regulatory reform makes this a good time to bet big on small cap growth stocks.

All investment strategies have their seasons.

And today’s investment season is small cap growth.

I recommend you make hay while the sun still shines.

Good investing,

Nicholas