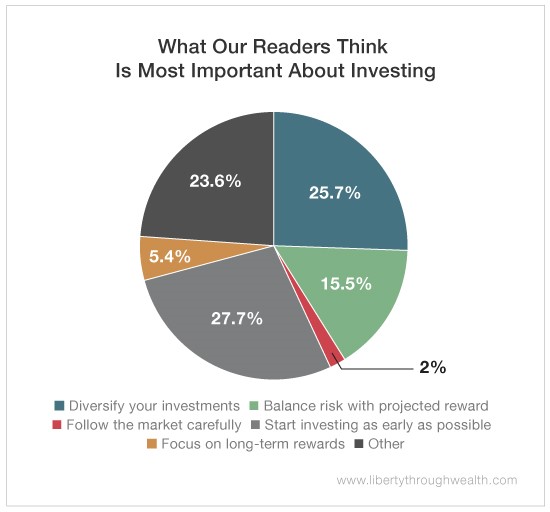

The week of September 24, we asked Liberty Through Wealth subscribers what they think is the most important thing to remember when investing. The answers are all over the map.

Of those polled, 27.7% believe that starting to invest as early as possible is the most important thing to keep in mind. Another 26% prioritize diversifying your portfolio, while 16% say you need to find the balance between risk and reward. Fewer believe it’s most important to invest for the long term and follow, or listen to, the market carefully.

Additionally, 5.6% of those who participated in the survey wrote in to stress the importance of patience, and 2.1% did the same to emphasize the need to research.

So who’s right?

All of you!

The truth is there’s no magic bullet when it comes to investing – each of these ideas is useful depending on what your goals are. And as goals change, so too might the approach you apply to your investment portfolio.

Chief Investment Strategist Alexander Green regularly stresses how letting your money compound can lead to great wealth and how important diversification is for balancing risk and reward.

And, although not many of you thought so, focusing on the longer term while intelligently speculating can help protect the wealth you’ve built thus far and prevent you from losing money on short-lived fads.

We all may have different answers about what’s most important when it comes to investing – it depends on your personal investing style. But keeping these various ideas in mind will help you maximize gains and minimize losses no matter what the market throws your way.

Good investing,

Katherine