- Exchange-traded funds have completely revolutionized the way people invest.

- Today, Nicholas Vardy explains the major benefits of ETFs and how they trounce mutual funds.

Much of the investing world has been hypnotized by the roller-coaster ride of crazy cryptocurrencies. But there’s another financial revolution taking place all around us.

And that is the revolution in exchange-traded funds (ETFs). Consider these statistics:

- As of June 30, there are 2,280 ETFs listed in the U.S.

- ETFs represent $3.98 trillion in the U.S. and $5.64 trillion globally as of June’s close.

- The average daily value of U.S. ETF transactions is $87.9 billion.

- According to BlackRock’s recent “ETF Pulse Survey”, 52% of U.S. investors intended to invest in ETFs. 9 in 10 financial advisors also expected to invest in ETFs for client portfolios.

Overall, ETF investors are younger, more engaged and more optimistic about their financial futures than the general investor population.

In short, ETF investors are the future…

Six Ways ETFs Trounce Mutual Funds

The ETF industry has the mutual fund business on the run. And for good reason…

ETFs offer some massive advantages over mutual funds. In fact, I have to scratch my head wondering why anyone would want to invest in a mutual fund ever again.

Here are six advantages that make ETFs a no-brainer…

1. ETFs have no investment minimums, front-end loads or early redemption fees.

I won’t mince words here… The front-end loads and early redemption fees that some mutual funds still charge are a retail investor shakedown.

Contrast that with ETFs… Since ETFs trade like stocks, you can buy as few or as many shares as you want. And you can buy and sell ETFs when you want, without penalty.

With an ETF, you pay only the cost of the stock commission. At leading brokers like Fidelity and Schwab you can even trade ETFs for free.

2. ETFs offer real-time tracking.

Mutual funds price only once each trading day. In contrast, ETFs price all day long, just like stocks. That means ETFs reflect more accurately any sharp moves in the value of an underlying portfolio.

3. ETFs offer real-time trading.

Mutual funds are bought and sold only after the market closes. ETFs are bought and sold whenever the markets are open. ETFs are flexible and efficient. Mutual funds are old and stodgy.

4. ETFs are transparent.

Mutual funds disclose their holdings once per quarter. Meanwhile, ETFs must report their portfolios on a daily basis. With ETFs, you always know what you’re buying.

5. ETFs are tax-efficient.

Mutual funds generate taxable income as part of the regular process of buying and selling shares. That creates taxable capital gains. In contrast, ETFs exchange underlying securities in kind for ETF shares – a nontaxable event. That means you pay much lower – if any – taxes on ETF gains.

6. ETFs are cheaper than mutual funds.

And here’s my favorite advantage that ETFs have over mutual funds…

The average mutual fund charges a management fee of 1.13%. In contrast, the average ETF has an expense ratio of 0.44%. Put another way, the average mutual fund is a whopping 157% more expensive than the average ETF.

How much impact can high fees have on your returns? Consider this extreme example…

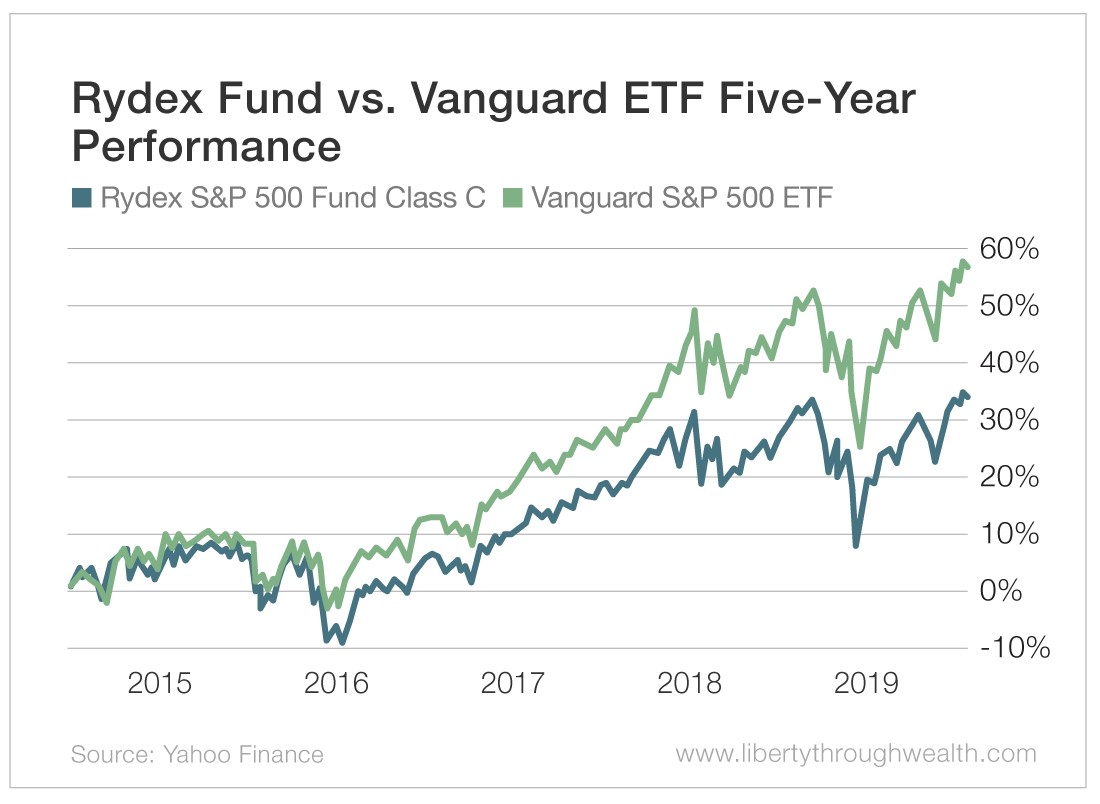

The Rydex S&P 500 Fund Class C (Nasdaq: RYSYX) charges 2.31% per year to track the S&P 500 Index. In contrast, the Vanguard S&P 500 ETF (NYSE: VOO) – with an identical strategy – charges only 0.04%.

That means the Rydex Fund is almost 5,700% more expensive than its Vanguard counterpart. And if the implications of that are hard to get your head around, just look at the chart below…

A “Bonus” Seventh Advantage

The six advantages of ETFs above are key to why mutual funds are destined for the dustbin of financial history. Yet I think ETFs offer an even more crucial seventh advantage: the diversity and creativity of ETF providers.

Earlier this week, I compared ETFs to Lego building blocks because they allow you to build, brick by brick, a portfolio to fit your specific investment objectives.

With ETFs, you can invest in almost any asset class – whether it’s stocks, bonds, commodities or currencies. You can invest in dozens of different investment strategies.

You can leverage your investments two or even three times. You can even bet against the stock market and make a fortune from a market crash.

The range of ETF investment opportunities seems infinite.

The ETF space is also remarkably creative. There are ETFs for every asset class, theme and sector you can think of. If there is a new investment theme on the horizon, you can be sure that someone is working on a related ETF.

So far this year, a wide variety of ETFs have launched – including ones focused on the “gig economy,” digital payments, space exploration, crowdfunding, esports, genomics and cannabis.

Whatever the asset class, whatever the investment theme, whatever the current direction of the market… there’s probably an ETF in which you can invest.

My job as The Oxford Club’s ETF Strategist and Editor of our ETF trading service, Oxford Wealth Accelerator, is to guide you through the jungle of opportunities that the ever-expanding world of ETFs offers…

And to recommend the ETFs I believe will make you the most money, no matter what the market is doing. I hope you’ll join me on this journey in the months and years ahead…

Good investing,

Nicholas