- Slowing global growth and increasing economic uncertainty have led to a fair amount of investor panic lately.

- Today, Nicholas Vardy shares two investment strategies that investors can use to protect themselves and grow their ETF portfolios.

Slowing global growth… the escalating trade war with China… the ever-looming threat of yet another market-crushing Trump tweet… The uncertainty surrounding global financial markets has hit investor sentiment hard.

The CNN Fear & Greed Index has slipped back near 20, signaling extreme fear.

Investors have pulled $18 billion from stock-related exchange-traded funds (ETFs) over three weeks.

While there are reasons to be cautious… it’s best to think through the prospects of a market pullback calmly – and not throw out the baby with the bathwater.

Luckily, ETFs allow you to home in on the right sectors and strategies that enable you to profit from whatever direction the market is going.

Today, I want to discuss two sophisticated investment strategies – represented by two ETFs – each of which can protect your portfolio during a market downturn.

No. 1: Bet on the “Black Swan”

Popularized by Nassim Nicholas Taleb, the term “black swan” refers to a rare, unexpected and high-impact event. In investing, black swans happen when financial markets fall fast and hard – as they did during the crash of October 19, 1987.

Viewed through the lens of college statistics, these black swans should never happen. But reality teaches us otherwise. For example, the crash of 1987 was a “20-sigma” event. Meanwhile, a six-sigma event would occur one day out of every 4,039,906 years.

So how can you protect your portfolio?

You could structure a complex batch of options strategies like Taleb does. Or you could buy an ETF that implements an options strategy for you.

Specifically, the Cambria Tail Risk ETF (CBOE: TAIL) invests about 5% of its assets in a portfolio of out-of-the-money put options on the S&P 500. It holds the rest of the assets in 10-year U.S. Treasurys. Both Treasurys and put options tend to rise during a market crash.

But like any other form of insurance, this protection costs money. Cambria spends roughly 1% of the fund’s total assets purchasing put options over rolling one-month periods. So this “insurance” costs you about 1% per month.

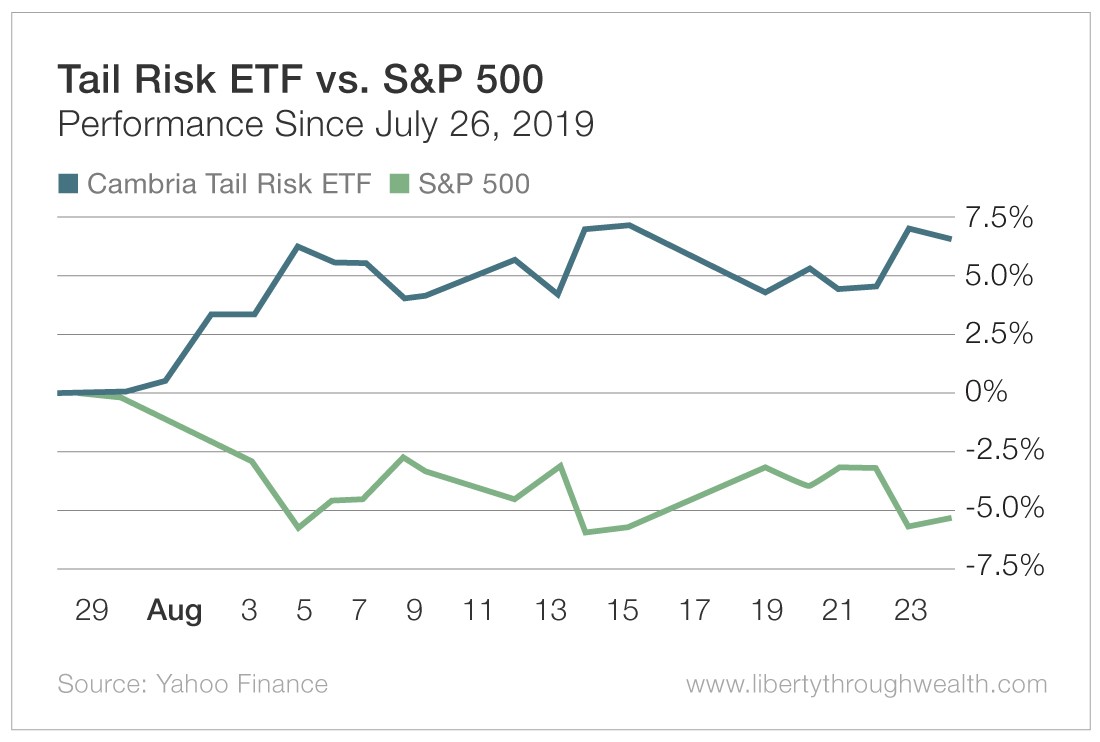

How has this ETF fared in the recent market pullback?

Pretty much as advertised. Since the market peaked on July 26, the S&P 500 has fallen about 5.4%.

Meanwhile, the price of the Tail Risk ETF has risen by more than 6.5%.

No. 2: Invest in the “Smartest” Smart Beta ETF

I’ve written before about “smart beta” ETFs. One of the smartest smart beta strategies I’ve ever come across is yet another Cambria-sponsored ETF.

The Cambria Core Equity ETF (NYSE: CCOR) is the closest thing to a sophisticated hedge fund in the ETF space I’ve ever seen. The Core Equity ETF combines several sophisticated strategies to generate consistent gains while tightly controlling risk across a wide range of market conditions.

Both its strategy and real-world performance make it a worthy competitor to some of the most sophisticated hedge funds on the planet.

Let’s examine how the Core Equity ETF achieves all this…

First, 80% of the value of the fund’s net assets is invested in high-quality U.S. stocks across all industries and sectors.

Second, the fund sells exchange-traded index put and call options. This strategy reduces volatility and increases returns independent of the direction of the broader U.S. equity market. (If you are an options trader, you’ll recognize this as the “Iron Condor” strategy.)

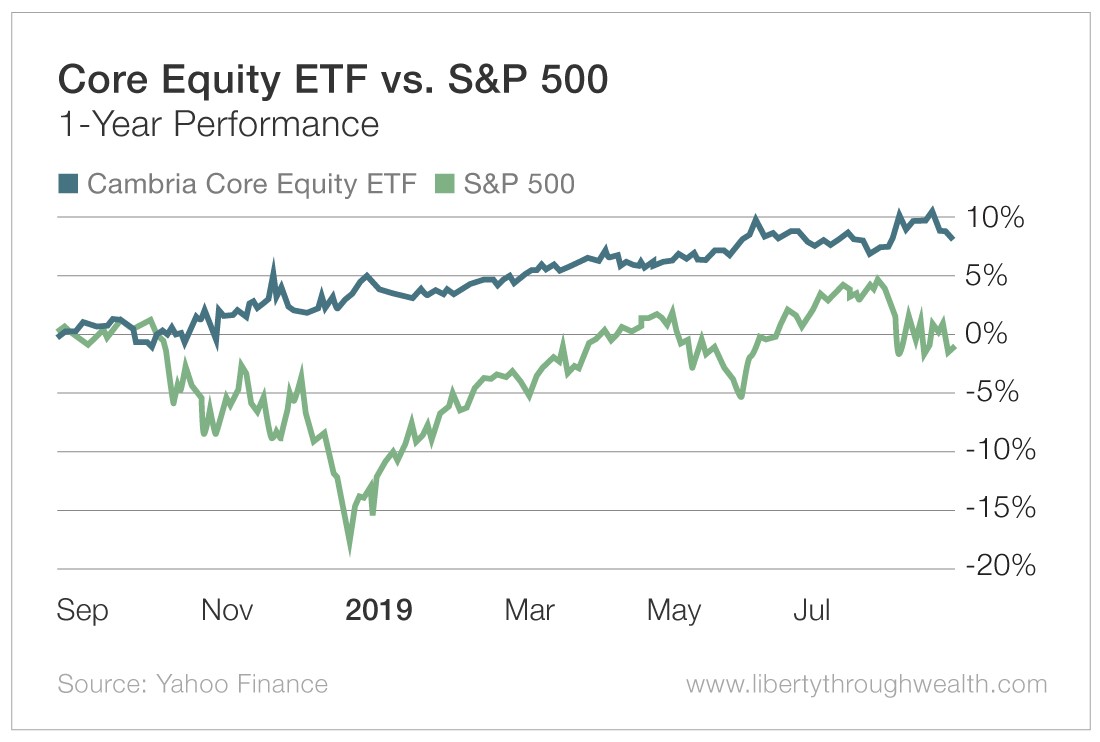

Finally, the fund buys index put options, protecting it from significant short-term market declines. The results speak for themselves.

This strategy shines the most when markets are the most difficult. Over the last three months of 2018 – some of the harshest trading conditions I’d ever seen – the Core Equity ETF outperformed the S&P 500 by an astonishing 19%!

Over the last six months, Core Equity broadly matched the performance of the S&P 500 – but without any of the hair-raising volatility.

Both of these ETFs offer the kind of sophisticated investment strategies that were off-limits to small investors as recently as 10 years ago.

And offer yet another reason you should join the ETF revolution.

Good investing,

Nicholas