Regular readers know that we have been on the right side of this market for 11 months now.

Subscribers to my investing newsletter, The Oxford Communiqué, are sitting on a pile of profits in our four portfolios (in addition to the gains we’ve already taken).

Did we simply guess right about the direction of the market while the majority of investment analysts and market pundits guessed wrong, especially early in the pandemic?

Not at all.

We correctly analyzed the severity of the pandemic, the effect on the economy and the timetable for vaccines, while most COVID-19 “experts” and other pessimists were dead wrong.

Eleven months ago, they told us it would take years to develop a vaccine and get it approved.

Yet Moderna (Nasdaq: MRNA) developed a vaccine within two days of China posting the coronavirus genome online (and nabbed a triple-digit gain in my Insider Alert trading research service).

The Food and Drug Administration approved it nine months later.

The experts told us that distribution would be extremely problematic, that most Americans would be reluctant to get a vaccine that was developed so rapidly and that there was no guarantee that those who got vaccinated wouldn’t still be vulnerable to the disease.

The news over the past few weeks has been terrible for the naysayers. But entirely positive for us and our portfolios.

A new Gallup poll reveals that 71% of Americans say they will get the vaccine, the highest percentage yet.

Moreover, the Centers for Disease Control and Prevention reported that those who have received a second dose of the vaccine will not need to quarantine themselves if they come into contact with someone with COVID.

COVID cases are down 77% over the last six weeks.

Now many medical experts, including Dr. Marty Makary, a professor at the Johns Hopkins School of Medicine and Bloomberg School of Public Health, estimate that “about 55% of Americans have natural immunity.”

Add to that the number of people who have received the vaccine, approximately 15% of Americans.

Bottom line? The country is racing toward herd immunity and an extremely low level of infection.

In a recent Wall Street Journal editorial, Dr. Makary concludes that “Covid will be mostly gone by April, allowing Americans to resume normal life.”

In short, we are only weeks away from a robust reopening of the economy.

Throw in ultra-low interest rates, cheap energy, and unprecedented monetary and fiscal stimulus, and we are set for the biggest economic boom we’ve seen in years.

Goldman Sachs forecasts that U.S. GDP will increase 7% this year.

Investors increasingly recognize this and are busy incorporating the positive outlook into share prices.

That creates a risk, however. And it’s a substantial one.

Yes, consumer and corporate spending is about to rise sharply, as more people begin to shop, dine, travel, entertain and enjoy all the good things they missed over the past year.

And with interest rates so low, there are few attractive investment alternatives to equities.

The bad news is this reality is already priced into most stocks.

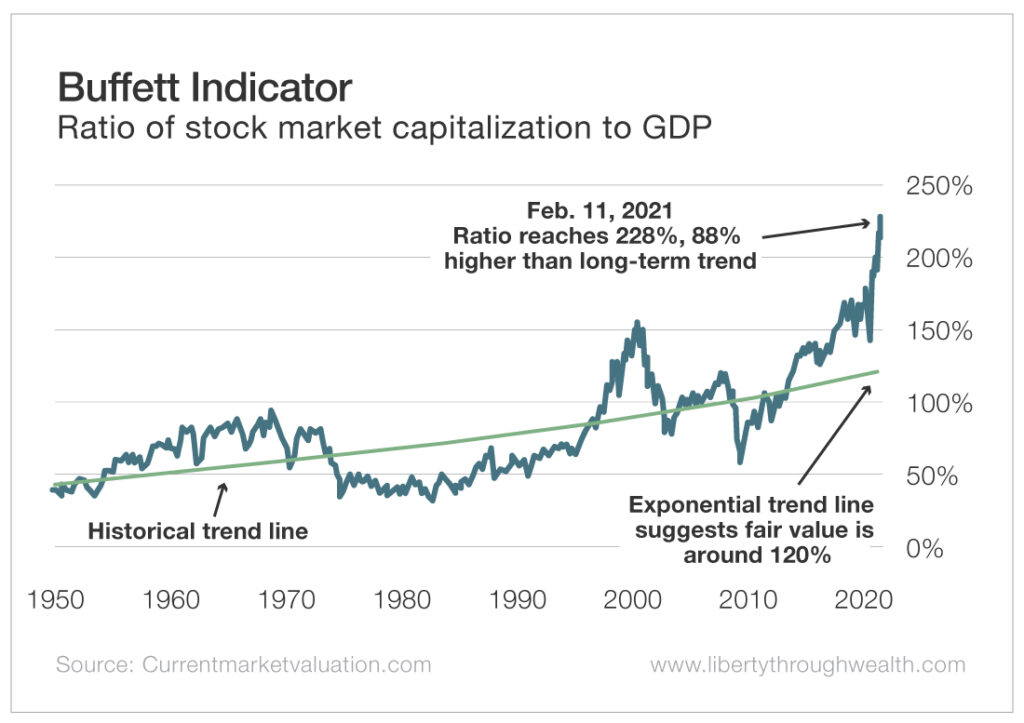

As a result, the so-called “Buffett Indicator” is at an all-time high.

Twenty years ago, Berkshire Hathaway Chairman Warren Buffett described the stock market capitalization-to-GDP ratio as “the best single measure of where valuations stand at any given moment.”

According to Buffett, “If the ratio approaches 200%… you are playing with fire.”

Well, ring the alarm.

Because the ratio recently hit 228%. That’s not just an all-time high but 88% higher than the long-term trend line.

By this measure, the stock market is as overvalued as it has ever been.

Does this mean you should sell your stocks and run to cash?

No. Buffett is not a market timer and neither am I.

Stocks have to be valued relative to other investments, especially bonds and cash.

(And you can bet that 20 years ago, Buffett – like everyone else – didn’t imagine zero interest rates or trillions of dollars of global debt sporting negative yields.)

With risks growing along with the outlook for the economy, this is a good time for a portfolio check.

Make sure you are comfortable with your equity allocation now that the market has risen nearly 90% over the last 11 months.

Check to see that your stock portfolio is diversified among large and small companies, growth and value stocks, and international as well as domestic markets.

Run trailing stops behind most of your individual stock positions.

(These give you unlimited upside potential with strictly limited downside risk.)

And own some noncorrelated assets like Treasury Inflation-Protected Securities (TIPS), real estate investment trusts (REITs) and gold shares.

It’s been famously said that no one rings a bell at the top of the market.

But when sky-high valuations meet investor euphoria, it’s a danger signal.

So follow these basic steps, restrict your new buys to best-of-the-best opportunities, and buckle your seat belt.

Even if the market is headed substantially higher – and it may well be – it’s likely that the ride turns bumpier in the weeks and months ahead.

Good investing,

Alex

Click here to watch Alex’s latest video update.

For Alex’s latest video updates, subscribe on YouTube.