Editor’s Note: Below Nicholas Vardy explains how modern art collectors could teach investors a thing or two…

For starters, when you’re sitting on one Picasso, you don’t have to worry about the 99 duds in your art collection.

But if you’re still looking for your investment equivalent of a “Picasso,” a good place to begin is Alexander’s Green’s Single-Stock Retirement Play.

This one stock could be the key to your retirement savings.

Tune in now for all the details.

– Madeline St.Clair, Assistant Managing Editor

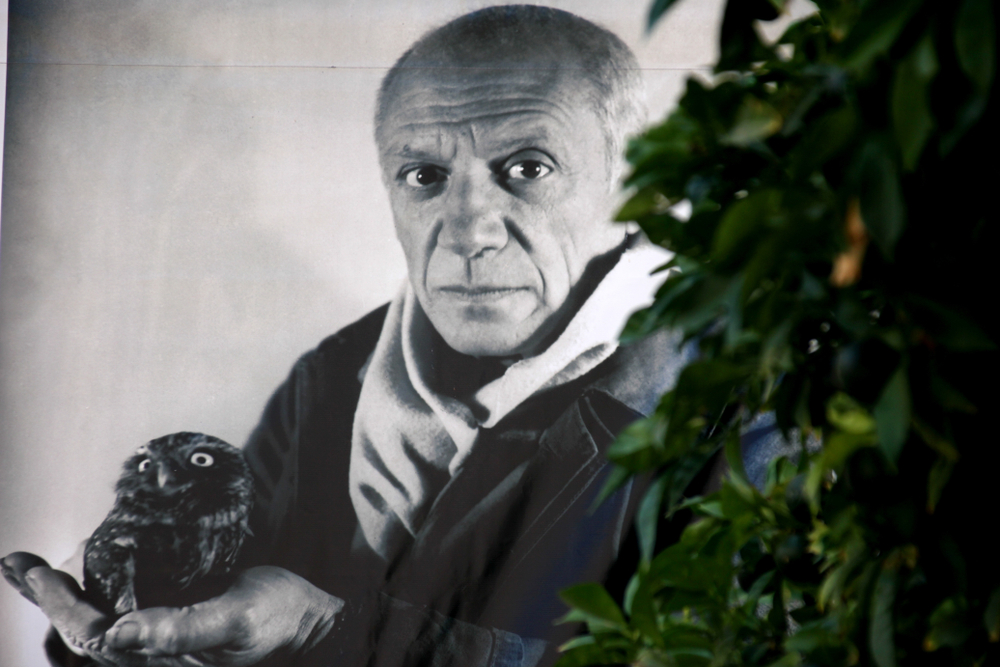

You can look at a Picasso one of two ways.

If you’re a rank amateur, you think, “My kid could do the same thing.”

If you are one of the world’s great art collectors, you instantly recognize it as a product of genius…

Or do you?

As it turns out, evaluating modern art can be as challenging as… well… identifying the next market-crushing stock.

But it is possible to identify the biggest stock market winners of tomorrow.

Though it requires a particular strategy – one I’ve never seen discussed in a standard investment textbook.

It’s a strategy used by venture capitalists (VCs) in Silicon Valley, movie producers in Hollywood and book publishers in New York.

And yes, even collectors of modern art.

The Remarkable Life of Heinz Berggruen

Heinz Berggruen showed little interest in the art world as a young man.

After fleeing Nazi Germany in 1936, he wasn’t sure what to do with his life.

He studied literature at the University of California, Berkeley. Afterward, he worked as a journalist and part-time art critic.

Later, while on his honeymoon, he bought a small watercolor by an artist named Paul Klee for around $100.

This small investment launched Berggruen’s career in modern art.

Fast-forward to the 1990s, and Berggruen had become one of the most successful art collectors of all time.

His collection of 165 works – including 85 Picassos, over 60 works by Klee and 20 by Henri Matisse – became one of the most important collections in the world.

And at the time, Berggruen valued his collection at 750 million euros (about $1 billion).

What was Berggruen’s grand strategy to amass this impressive collection of the 20th century’s greatest artists?

Was he simply gifted with an uncanny eye for modern art?

The truth is far more prosaic.

It turns out that all great collectors do the same thing.

They buy vast quantities of art.

A handful of acquisitions in their portfolios turn out to be great investments.

The majority, however, are duds.

The trick is to hold on to the few winners until they make up most of the portfolio's value.

Berggruen’s collection was spread across a wide range of artworks.

But rather than just buying pieces he happened to like or admire, he bought everything he could get his hands on.

And then he sat back and waited until a few winners emerged.

Lessons for Average Investors

On the surface, art collectors and Silicon Valley venture capitalists have little in common.

Yet when it comes to investing – or collecting art – they think the same way.

Silicon Valley VCs know that NOT investing in the next Alphabet (Nasdaq: GOOGL) or Uber (NYSE: UBER) is the real risk.

Miss out on the few big winners that could account for all of your gains… and your returns would approach zero.

As it turns out, Hollywood producers think the same way about movies.

Publishers think the same way about books.

They all know that a few big investments, blockbuster movies or bestselling books will make all the difference.

As Silicon Valley angel investor Jason Calacanis puts it, “A grand slam is worth 100 home runs.”

Modern art collectors think much the same way.

They know that investing in no-name artists is inevitable.

But it’s part and parcel of the process.

And when you’re sitting on one Picasso, you don’t have to worry about the 99 duds in your art collection.

And Berggruen made sure that he was sitting on a lot of Picassos.

That’s not a bad way to think about your investments.