The stock buyback boom is on.

The Trump tax cuts reduced the corporate tax rate from 35% to 21%. It also gave companies tax breaks when they repatriate foreign profits.

This one-two punch triggered a surge in U.S. companies buying back their own stock.

Publicly traded companies are on track to spend a record $1 trillion in stock buybacks this year alone.

Apple (Nasdaq: AAPL) accounts for 10% of that number with its record $100 billion buyback announcement in May.

Here are the biggest stock repurchase plans of 2018:

- Apple – $100 billion

- Cisco – $25 billion

- Wells Fargo – $22.6 billion

- Pepsi – $15 billion

- AbbVie – $10 billion

- Amgen – $10 billion

- Google parent Alphabet – $8.6 billion

- Visa – $7.5 billion

- eBay – $6 billion

- Applied Materials – $6 billion.

Even the ultra-conservative Berkshire Hathaway Inc. (NYSE: BRK-B) loosened its stock buyback plan.

CEO Warren Buffett and Vice Chairman Charlie Munger can now repurchase stock when the price is “below Berkshire’s intrinsic value” as opposed to below a 20% premium to book value. (How intrinsic value is determined is anyone’s guess.)

With this explosion in stock buybacks, it’s worth examining the theory behind them.

As a rule, company managements have better information about the value of their company than outside investors or analysts.

As such, at certain times, they may view their stock as more valuable than the public market does.

By buying back and retiring stock, management reduces the number of company shares outstanding, thereby increasing a company’s earnings per share.

By buying shares below their fair value, management essentially transfers wealth from the sellers to the remaining shareholders.

As a stock market investor, I think of buybacks as a floor on the price of a stock.

For example, when Berkshire Hathaway’s policy was to buy back the stock whenever it fell to 1.2 times its book value, investors could be confident the stock price would rarely fall below that level.

Timing Buybacks

Of course, companies don’t buy back their stock all the time.

Like any investor, they prefer to wait for opportune moments – say, after an unwarranted hit to the stock’s price.

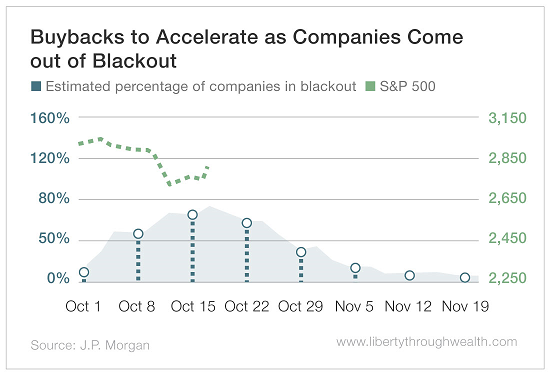

Analysts at J.P. Morgan suggest we are near just such an opportune moment today.

Here’s why…

Many companies have blackout periods around earnings announcements that restrict them from trading their shares.

But once these earnings-driven blackouts expire… it’s game (back) on.

The chart below is revealing…

Note how the highest percentage of buyback blackouts in the first half of October corresponded closely with the sharp pullback in the U.S. stock market.

The good news is that by November 6 – about two weeks from now – the current round of buyback blackouts will be mostly history.

Furthermore, lower stock prices after the current pullback will only spur the buyback process.

All this will likely add up to a significant rise in buybacks in the final two months of 2018.

How can you best profit from this coming uptick in corporate buybacks?

First, focus on companies with the largest buyback programs, including the top 10 companies listed above.

Second, you can buy exchange-traded funds (ETFs) that invest in companies that are actively buying back their stock.

The leading buyback ETF is the Invesco BuyBack Achievers ETF (Nasdaq: PKW). It tracks the Nasdaq US BuyBack Achievers Index, which invests in companies that have reduced their outstanding shares by 5% or more in the trailing 12 months.

The success of this rules-based “smart beta” strategy has been mixed.

Yes, over the past decade, the Nasdaq US BuyBack Achievers Index has outpaced the S&P 500 by an impressive average of 1.67% each year.

But the ETF’s track record has faltered over the past five years…

What explains its lagging performance?

As it turns out, gains in the S&P 500 and Nasdaq in 2018 have come almost exclusively from a handful of technology stocks.

And the BuyBack Achievers ETF portfolio of 128 stocks simply casts too wide a net.

This ETF has two additional downsides…

Its 0.63% annual fee is too high. In today’s competitive environment, an ETF that simply tracks a benchmark should charge no more than 0.30%.

Its high turnover also reduces after-tax returns substantially.

So should you buy into the buyback boom?

The answer is (probably) yes.

But investing in an overdiversified high-fee, high-turnover ETF like the Invesco BuyBack Achievers ETF is not the way to go.

Better to stick with bets on individual stocks.

Good investing,

Nicholas