Ray Dalio is the most successful hedge fund manager of all time.

As the founder of Bridgewater Associates – the world’s biggest hedge fund firm – Dalio manages more than $160 billion.

Since its inception, Bridgewater has made a total of $57.8 billion for investors.

(George Soros’ fund ranks second, having generated $43.9 billion in profits since inception.)

Central to Dalio’s success is his brainchild – the “All Weather” Portfolio.

In 2013, Dalio revealed a simplified All Weather Portfolio to self-help guru Tony Robbins.

Robbins went on to publish it in his book MONEY Master the Game: 7 Simple Steps to Financial Freedom.

Dalio designed the All Weather Portfolio to sail through all financial storms.

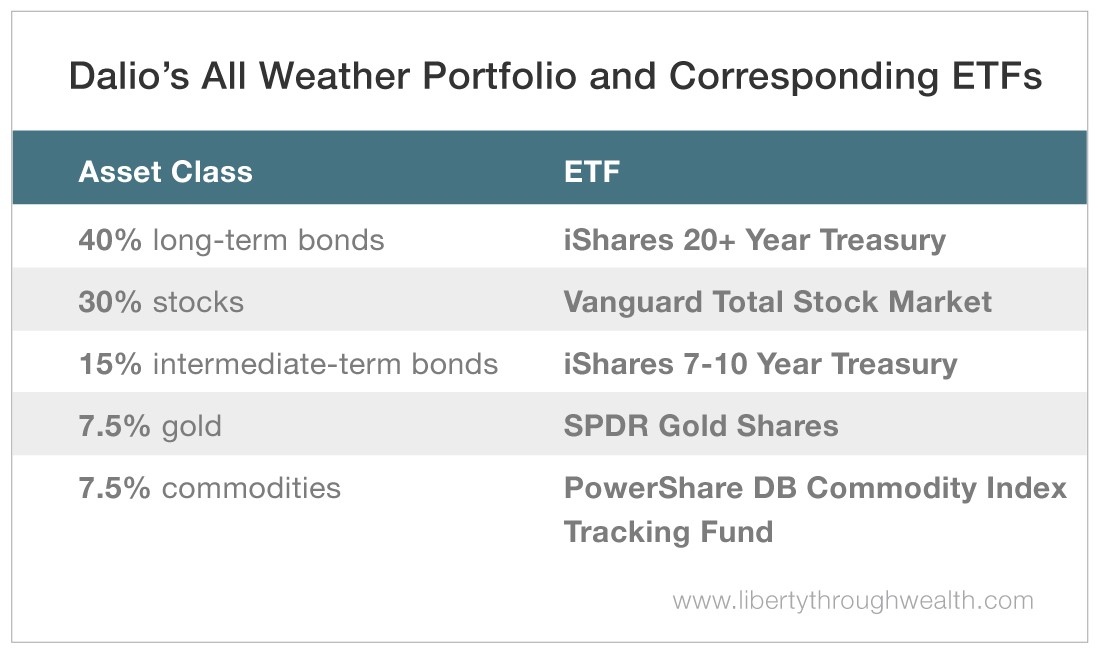

But its secret is a simple asset allocation strategy. And any investor can replicate it with low-cost exchange-traded funds (ETFs).

I’m Not Impressed

I’ve looked closely at Dalio’s All Weather Portfolio. And I always come to the same conclusion…

Its recent performance confirms my skepticism.

Between 1996 and 2018, the All Weather Portfolio generated returns of roughly 7.5% per year.

But its performance has deteriorated badly since 2013.

Over the past five years, All Weather has generated an average annual return of just 4.8%.

Hindsight is 20/20…

But All Weather’s lousy performance seems inevitable.

Two of the biggest bull markets of the decade leading up to 2013 were in gold and bonds.

Both have faltered since then.

Yet the All Weather Portfolio calls for investing 62.5% of its assets in just these two lagging asset classes.

I remain a big believer in asset allocation.

It’s just that I think All Weather does a lousy job.

Introducing the Oxford Endowment Portfolio

Let’s turn to another expert in the world of asset allocation…

A legend in the world of endowment investing, David Swensen heads the Yale University endowment.

Thanks to Swensen, Yale’s long-term investment performance stands among the very top of university endowments.

Over the past 20 years, the average return for college and university endowments has been about 6.8%.

For Yale, it’s been 11.8%. (That’s more than four percentage points higher each year than Dalio’s All Weather Portfolio.)

So what is Yale’s “secret sauce”?

Swensen was the first to apply modern portfolio theory to multibillion-dollar endowments.

Modern portfolio theory tells us that asset allocation explains up to 90% of a portfolio’s investment returns.

Swensen believes that if you diversify into asset classes beyond traditional U.S. stocks and bonds…

You can construct a portfolio that generates higher returns at lower risk.

You see the impact of Swensen’s thinking in the evolution of Yale’s portfolio.

In 1987, nearly 80% of Yale’s endowment was invested in U.S. stocks and bonds.

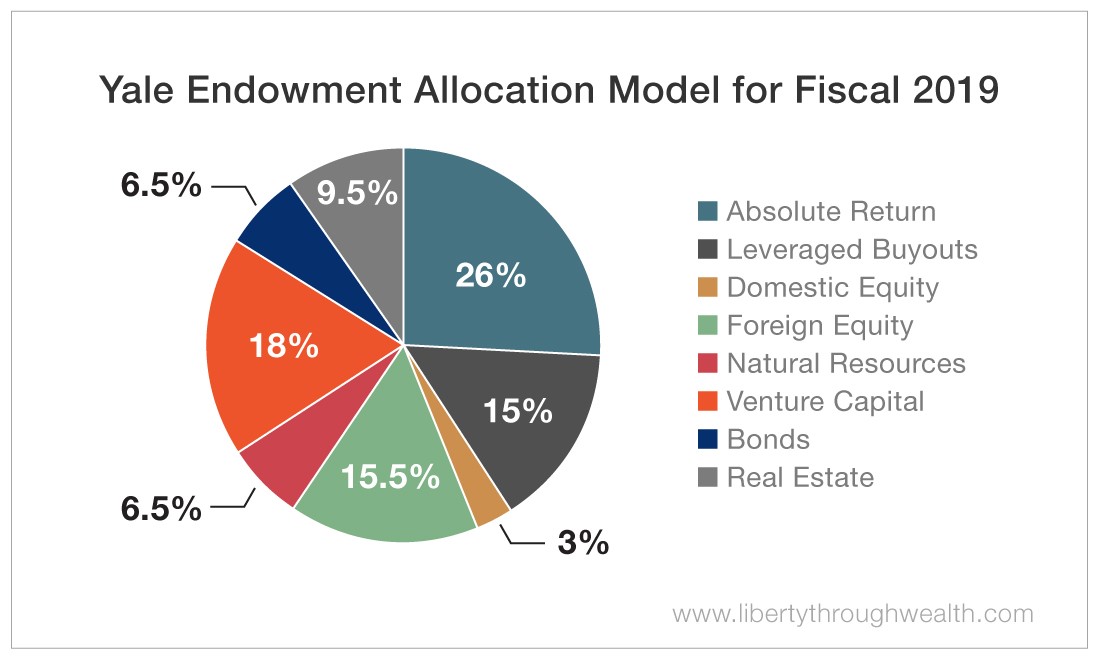

Over the past 30 years, Yale shifted the bulk of its investments into “alternative assets.” These assets include natural resources, venture capital, real estate and foreign stocks.

Today, the Yale endowment looks very different from what it looked like 30 years ago.

Swensen has argued that as a small investor, you have no chance of matching Yale’s market-beating returns.

After all, Yale invests with the top investment managers in the world.

Furthermore, you can’t invest directly in venture capital and timberland.

Here’s why I disagree…

Asset allocation explains up to 90% of a portfolio’s investment returns.

So it’s the decision whether to invest in, say, emerging markets or hedge funds that matters…

Not which fund in that asset class you invest in.

A 2010 study in The Journal of Wealth Management examined whether you could replicate Yale’s results using index funds.

Its conclusion?

“Consistent exposure to diversified, risk-tilted, equity-oriented assets” explains a big chunk of the Yale endowment returns.

That’s why I’ve developed the Oxford Endowment Portfolio, which replicates the asset allocation strategy of the Yale endowment using ETFs.

So how does the performance of the model Oxford Endowment Portfolio fare compared with the All Weather Portfolio?

As it turns out, it’s not even close.

Over the past three years, the model Oxford Endowment Portfolio would have returned an average of 9.5%.

The All Weather Portfolio generated a mere 5.1%.

The lesson?

If you want to generate investment returns like Yale, you need to invest beyond U.S. stocks and bonds…

And include nontraditional asset classes like timber, private equity, real estate, and global stocks and bonds in your portfolio.

ETFs allow you to do just that.

Good investing,

Nicholas