Editor’s Note: In today’s article, Nicholas Vardy explores the differences between hedgehogs and foxes in the investing world.

If you find yourself wanting to gravitate toward a fox’s levelheaded approach, you could turn to Alexander Green’s latest opportunity.

Alex says investing success comes from identifying great companies with breakthrough technologies.

He recently uncovered the biggest development in medical technology in half a century. Longtime Oxford Club Member Bill O’Reilly is even calling it “humanity’s next great leap.”

Together, Alex and Bill discuss how you can get in early on this little-known company that only recently went public and is already taking in tens of millions of dollars…

– Nicole Labra, Senior Managing Editor

Pundits make predictions on TV and other media outlets every day.

Whether it’s about the direction of the stock market…

The prospect of recession…

Or the future of disruptive technologies…

Experts inundate us with endless predictions.

Here’s what’s ironic…

No one ever calls these pundits out for the accuracy of these visions of the future.

Enter Philip E. Tetlock, a psychology professor at the University of Pennsylvania.

Tetlock’s life’s work is to test the accuracy of experts’ predictions across a wide range of subjects.

And the results – detailed in Tetlock’s book Superforecasting: The Art and Science of Prediction – aren’t flattering.

Tetlock’s research confirmed that Wall Street pundits’ stock predictions are no more accurate than the proverbial chimpanzee throwing darts at the pages of The Wall Street Journal.

However, Tetlock did identify the kind of expert you should listen to.

And identifying the right kind of expert can make all the difference for your financial future.

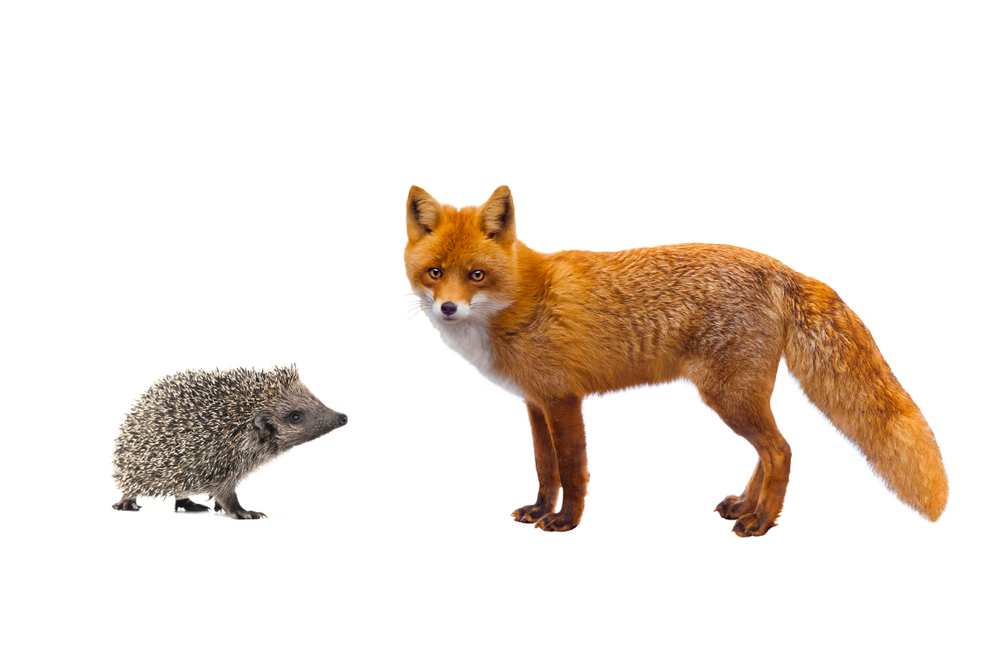

The Fox and the Hedgehog

Borrowing a metaphor from Oxford philosopher Isaiah Berlin, Tetlock divides experts into two broad types: “foxes” and “hedgehogs.”

Berlin had borrowed the terminology from the ancient Greek quote “The fox knows many things, but the hedgehog knows one big thing.”

Hedgehogs are the media’s professional commentators.

They dominate the airwaves and the speaking circuit.

They offer entertaining, broad and hard-to-test predictions. Each of these predictions is built around one “big idea.”

They provide simple answers to complex questions. They are highly confident in their abilities, even when their predictions are wrong.

This unwavering self-assurance makes them deceptively convincing.

The most recent example is Cathie Wood, manager of the Ark Innovation ETF (NYSE: ARKK).

Review any of Wood’s dozens of media appearances, and her answer to every question is “disruptive technology.”

Wood is nothing if not consistent.

Always wrong but never in doubt, Wood remains both on point and on message – even after losing her investors 70% of their investment in her funds.

The simplicity of a hedgehog’s message also means hedgehogs do well on TV.

As Tetlock points out, hedgehogs are on TV not because they’re good at predictions… but because they’re good at telling a story.

Let’s now turn to foxes.

The contrast with hedgehogs could hardly be greater.

Foxes have a sophisticated, self-critical style of thinking.

They are concerned with possibilities more than certainties. They are “actively open-minded thinkers” who keenly study views with which they disagree.

They understand that even contrary views may improve the accuracy of their predictions. They are rarely exuberant. They readily admit their errors.

That’s also why you’ll rarely see a fox on TV.

Their opinions are too measured, complicated and subtle to summarize in a sound bite.

Hedgehogs vs. Foxes Smackdown: Who’s Right?

In 2011, Tetlock launched the Good Judgment Project in the U.S. intelligence community to identify cutting-edge methods to forecast geopolitical events.

The results were sobering.

Tetlock found that only about 2% of experts were “superforecasters.”

Members of this select group were an astonishing 30% more accurate than intelligence analysts with access to classified information…

Tetlock identified the following characteristics of good predictors…

- Philosophic outlook: cautious, humble and nondeterministic

- Thinking style: open-minded, intelligent, curious, reflective and numerate

- Forecasting style: pragmatic, analytical, probabilistic, thoughtful updaters and intuitive psychologist

- Work ethic: growth mindset and grit.

What does this tell us about hedgehogs and foxes?

Tetlock found that foxes’ intellectual flexibility made them better predictors overall.

And that hedgehogs’ predictions were no better than random ones. More specifically, he found “a perversely inverse relationship between… good judgment… and the qualities that the media most prizes in pundits.”

As a TV producer at CNBC once told me, “[Hedgehogs] simply make for good TV.”

Investing With Hedgehogs: Caveat Emptor

So what does all this talk of hedgehogs and foxes have to do with investing?

It turns out the investment world is chock-full of hedgehogs.

In addition to Wood, they include gold bugs, “China miracle” types and the techno-optimists of Silicon Valley.

They are “doomsters” (Jim Rogers, Peter Schiff and Nouriel Roubini), “boomsters” (Elon Musk and Peter Diamandis) or both (Harry Dent).

Much like Wood, these hedgehogs have gotten a lot of things wrong.

Gold did not go to $5,000 an ounce in 2012.

Chat board predictions notwithstanding, meme stock AMC Entertainment (NYSE: AMC) never went to $1,000.

Investors made a lot more money investing in the U.S. than they did investing in the China miracle.

Hedgehogs remind me of old-time, late-night TV preachers.

They pull you in with their fire-and-brimstone predictions.

But as with these preachers’ pleas for money, listening to hedgehogs could cost you much of your hard-earned cash.

My recommendation?

Don’t take investment advice from a hedgehog. Stick with the measured approach of a fox instead.