Stock-picking contests have little to do with real investing.

You can pick only one stock. You can’t change your mind. And you have to hold on to the stock no matter what.

If the restrictive rules of a stock-picking contest weren’t bad enough…

Winning isn’t even about picking the best stock.

As John Maynard Keynes once suggested, a stock-picking contest is not much different from a beauty contest. You need to guess who others think is the most attractive – or, to take it further, guess what others think about what others think is the best choice – in order to win.

So it was with mixed feelings that I entered The Wall Street Journal’s Summertime Stock Picks contest running from August 1 through December 14.

To kick it off, The Wall Street Journal’s “Heard on the Street” writers picked their favorite investment ideas.

I entered the contest on August 28 with Direxion Daily MSCI Brazil Bull 3X ETF (NYSE: BRZU) – a triple-leveraged bullish bet on the Brazilian stock market.

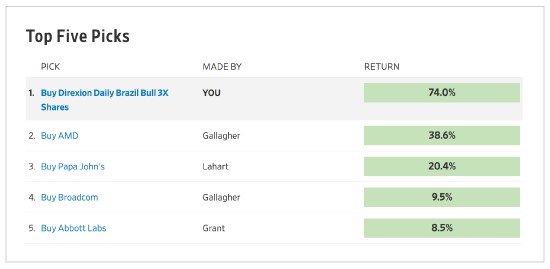

And as the chart below confirms, I am crushing it. I am currently ranked No. 1 by a margin of more than 35%.

Today, I want to take you through why I chose Brazil…

And why my choice relies more on Keynes’ beauty contest metaphor than on rigorous fundamental analysis.

If I were making a traditional argument for investing in Brazil, here’s what I’d say…

I’d regale you with colorful anecdotes about the massive economic potential of Brazil – a country with a population of 208 million and a landmass 13 times the size of Texas.

I’d explain how the Brazilian stock market is cheap – its long-term cyclically adjusted price-to-earnings (CAPE) ratio of 13.3 makes it a bargain compared with the U.S. market’s CAPE of 31.9.

I’d tell you how – after a sharp sell-off – emerging markets are due for a bounce. I’d mention how, in my experience, the fourth quarter tends to be particularly strong for that sector.

Alas, none of these arguments entered my investment calculus when choosing the Direxion Daily MSCI Brazil Bull 3X ETF.

In betting on Brazil, I was looking for a single thing: a psychological catalyst that could move the market over the short term.

And Brazil had that catalyst in presidential candidate Jair Bolsonaro – a colorful, far-right former army captain – dubbed the “Trump of the Tropics.”

Promising to restore “traditional values” to Brazil, Bolsonaro mastered social media to communicate directly with an electorate disillusioned with a corrupt political culture.

I recommended the Direxion Daily MSCI Brazil Bull 3X ETF based solely on my expectation that the Brazilian stock market would soar on the prospects of a Bolsonaro presidency. And this ETF offered a triple-leveraged way to bet on that.

Events unfolded mostly as I expected.

On October 8, Bolsonaro captured almost 47% of the vote in the first round of Brazil’s presidential election. Bolsonaro did fall short of the 50% required to win outright, which means a run-off election on October 28.

So should you go out and buy the Direxion Daily MSCI Brazil Bull 3X ETF?

Please don’t…

In fact, if had my druthers, I’d sell my position today, lock in my 74% gain and call it a day until the contest ended on December 14.

Here’s why…

Yes, there is a run-off election coming up at the end of the month. But I see no outcome that is bullish for the Brazilian stock market.

If Bolsonaro loses, it means that a socialist candidate will have won. And the Brazilian stock market will get crushed.

At the same time, a Bolsonaro victory is already baked into the price. Post-election euphoria tends to fade quickly… and it won’t take long for Brazil to fall back into its usual political quagmire.

No matter what the outcome, the Direxion Daily MSCI Brazil Bull 3X ETF’s impressive 74% gain will be history by the time The Wall Street Journal’s Summertime Stock Picks contest ends on December 14.

And my days at the top of this contest will be long gone.

Still, it was nice while it lasted…

Good investing,

Nicholas